Description

List of 5 large SaaS Venture Capital Investors

SaaS is short for software as a service. The market size for on-demand software was around $113,81B in 2020 and is estimated to grow even more in upcoming years. This article highlights five venture capital firms from our global VC investor list that are interested in SaaS startups.

1. Conviction Venture Capital (UK)

Conviction is a VC firm that is interested in B2B SaaS companies. They are privately backed and highly focused on growth startups. Since 2017 they have invested over $100M. Consensus is part of their portfolio. The company describes its business as a SaaS-enabled service that can increase confidence in open banking.

2. Forum Ventures (USA)

Forum Ventures, formerly known as Acceleprise, is a fund, program, platform, and community for B2B SaaS startups. Forum Ventures offers investments of $250K in each startup, as well as an “end-to-end fundraising playbook”. Furthermore, the fund grants access to an extensive network of seed and Series A investors. Portfolio companies include AlphaRank, adhusky, Adistry and Samply.

3. Hi Inov (France)

HiInov is a venture capital firm that supports startups from early stage to growth stage. They have €250M in assets under management and have backed 37 startups. Portfolio companies include diplomatic, cumul.io, awork, or Styla. Successful exits so far were interCloud or ermeo.

Update 2024: Hi Inov has announced the first closing of €75 million for the Hi Inov 3 fund. The company has achieved its first milestone with the support of its existing investors and a new, more diverse investor base comprising institutional investors, family investment holding companies, and entrepreneurs.

4. Speedinvest (Austria)

Another interesting SaaS startup investor is Vienna-based Speedinvest. The well-known venture capital investor has six focus areas: deep tech, fintech, health, industrial tech, marketplaces and SaaS. Successful portfolio companies in the SaaS vertical are Ledgy, Gitpod, upvest, mindsdb or actiondesk. Meanwhile, the fund is active in whole Europe.

Update 2023: In February 2023, Speedinvest announced that it led the funding round of SaaS startup konfetti. The Berlin-based startup offers a platform for courses and workshops.

5. Oxx Capital (UK)

The core focus of UK investor Oxx capital is B2B SaaS. The fund is looking primarily for software-as-a-service startups with a good product value proposition and tech stack. Recent investments include CyberSmart and Black Swan Data. The fund especially invests in later-stage rounds.

Included information in our SaaS investor list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 861) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.02) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „saas“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 630) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.forumvc.com/blog-categories/b2b-saas) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.2) – highest keyword rate per subpage

- frequency_per_keyword: {‘saas’: 541, ‘software as a service’: 0, ‘subscription model’: 1} – dictionary of number of keyword occurrences per keyword

Why B2B software-as-a-service are of particular interest for global VCs

The year 2022 was exceptionally challenging for the tech world. Many SaaS startups have suffered from increased economic pressure and have had to lay off employees. Nevertheless, a large number of venture capital investors continue to believe in the success of B2B SaaS companies. This is especially due to the prospects of predictable recurring revenues. Business customers, once acquired, are considered reliable and well-paying clientele. B2B SaaS startups will therefore continue to be very popular in the digital environment.

Picture Source: Austin Distel, Chris Ried, Slidebean

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

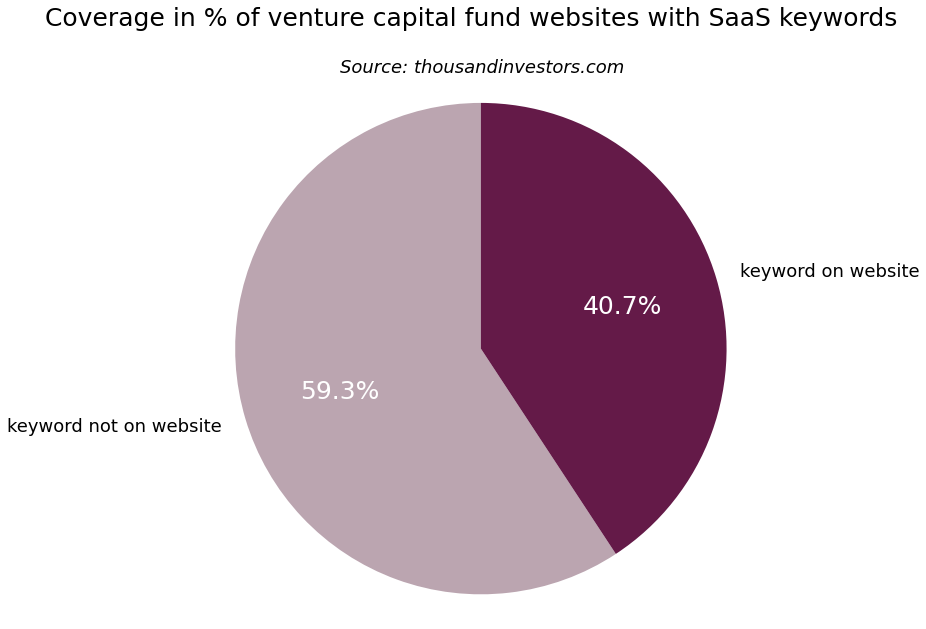

Percentage of VC funds that invest in the SaaS sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding SaaS investment keywords. We found out that 40.7 % of the global VC funds mention SaaS technology.

Focus on SaaS

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword SaaS to describe their vc company focus. Additionally, the term software as a service is used, whereas subscription service is not used as frequently.

Countries of SaaS startup investors

The most common country SaaS startup investors are located in is the USA. For instance, the previously presented investor Forum Ventures is located in New York. Also, a lot of SaaS technology investors are located in Germany, the UK, France, and Israel. As a result, these countries are home to many successful startups and are popular destinations for investors looking to invest in the technology sector.

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024] List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png)

![List of the 1,000 largest EdTech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Edtech-Investors-List.png)

![List of the 100 largest Immunology Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Immunology-VC-Investors-List.png)

![List of the 80 largest Vegan Food Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Vegan-Food-Venture-Capital-Investors.png)

![List of the 400 largest AgTech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Agtech-Investors-List.png)

Edmund (verified owner) –

Great list of software as a service startup investors, perfect matches

Björn Maronde –

Super well researched list. Always happy to be your customer