Description

List of 5 large battery technology venture capital investors

Due to the high demand for automotive applications, the request for batteries and new innovative, rechargeable, and sustainable solutions has increased significantly. This article presents five battery technology venture capital investors.

1. Partech (France)

Partech is a Paris-based VC firm for tech and digital companies that invests in seed, venture, and growth stages. As of now, Partech has $2.5B in assets under management and a portfolio of 240 companies. The company is active in Europe, North America, Africa, and Asia. Among other sectors, the portfolio includes companies from the battery sector. An example company is Zolar, a Berlin-based startup that offers battery and solar storage systems.

Update 2024: In December 2023, Partech launched its successor €360M venture fund to support mission-critical software, data, and fintech specialists in Europe. Additionally, they announced their first investment in Smartpricing.

2. bmp Ventures (Germany)

bmp Ventures is an innovative Venture Capital Company from Berlin, that invests in Early Stage and Growth Startups. The company’s record contains 250 investments over the last 25 years, over 120 Exits, and over 20 IPOs. An example company of bmp Ventures portfolio is NorcSi, a company founded in 2020 that develops innovative high-performance electrodes for use in lithium-ion batteries.

3. Phoenix Venture Partners (USA)

Phoenix Venture Partners is a VC fund with a multi-stage investment strategy for startups in the technology industry, especially regarding AI and the intersection of biology, advanced materials, hardware and advanced computation. They have, for example, invested in Imprint Energy. Imprint Energy has developed a printable and rechargeable battery technology called ZincPoly.

4. Parkwalk (UK)

Parkwalk is a VC company that has managed to raise over £400M and has invested the capital in over 150 companies. One of them is Helio, a project that develops light-emitting applications using perovskite materials and, therefore, are very power efficient.

5. TechSquare Ventures (USA)

Tech Square Ventures is an Atlanta-based venture capital firm that specialises in early-stage investments, with a particular focus on enterprise and marketplace technology companies. The areas of focus for TSV include applied artificial intelligence, logistics and supply chain, vertical solutions, infrastructure and productivity, as well as sustainability and energy. An investment made by TechSquare is in NuGen Systems, a company that manufactures lithium-ion rechargeable batteries designed for the indoor material handling equipment market. The company’s batteries are notable for their smaller size and longer lifespan when compared to traditional lead-acid alternatives, offering enhanced efficiency for clients. Another significant investment is in Pitstop, a fleet maintenance software provider that leverages AI-driven predictive analytics to deliver actionable insights.Pitstop’s platform enables fleets to anticipate and address vehicle issues proactively, thereby reducing downtime and maintenance costs. In April 2023, Pitstop secured $3.8 million in funding, with TSV leading the investment round.

Picture Source: Kumpan Electric via unsplash (04.07.2023)

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 694) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.006) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „batteries“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 445) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. http://www.braemarenergy.com/portfolio/#generalfusion) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.03) – highest keyword rate per subpage

- frequency_per_keyword: {‘batteries’: 252, ‘battery technology’: 0, ‘lithium ion’: 84} – dictionary of number of keyword occurrences per keyword

Picture Source: Kumpan Electric via unsplash (04.07.2023)

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

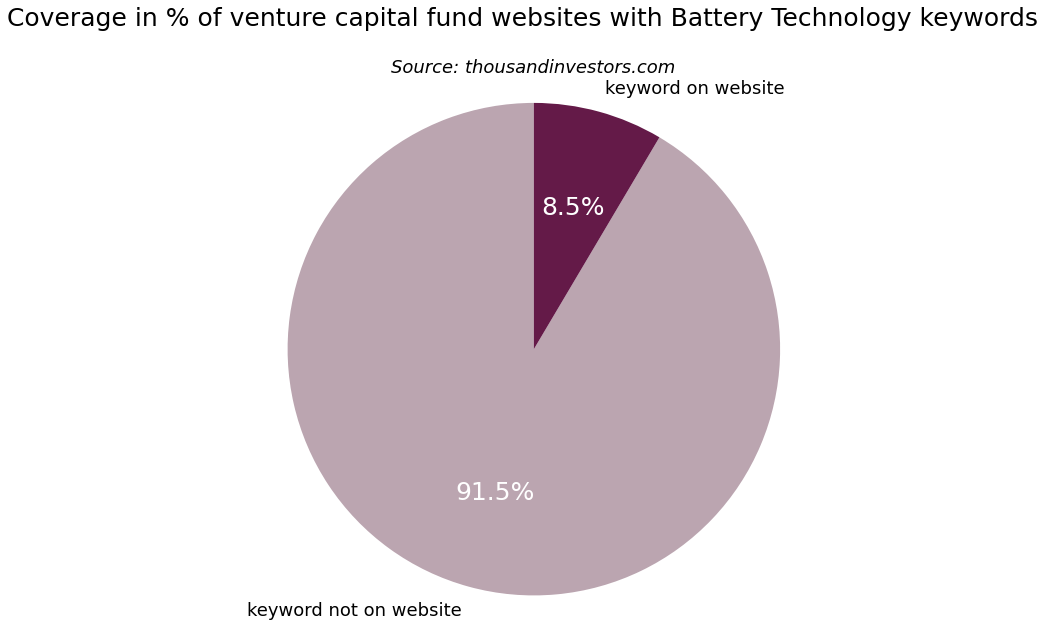

Percentage of VC funds that invest in the battery sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding battery investment keywords. We found out that 8.5 % of the global VC funds mention batteries.

Focus on batteries

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword batteries to describe their vc company focus. The terms lithium ion and battery technology are used less frequently.

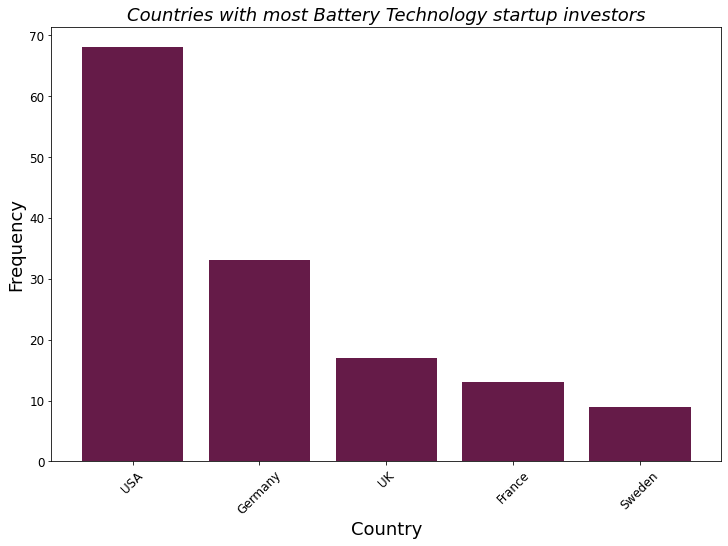

Countries of battery startup investors

The most common country battery startup investors are located in is the USA. For instance, the previously presented investor Phoenix Venture Partners is located in San Mateo, California. Also, a lot of battery investors are located in Germany, the UK, France, and Sweden. As a result, these countries are home to many successful startups and are popular destinations for investors looking to invest in the battery sector.

![List of the 200 largest Battery Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Battery-Technology-Investors-List.png)

![List of the 150 largest Oncology Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Thousand-Investors-Oncology.png)

![List of the 500 largest Gaming & Esports Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Gaming-eSports-Investors-List.png)

![List of the 700 largest Biotech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Thousand-Investors-Biotech.png)

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png)

Reviews

There are no reviews yet.