Description

List of 10 large global venture capital investors

Venture capital investors are investing in startups all over the world, thereby playing an important role in the funding of innovations. In this section, we are introducing you to 10 exciting venture capital investors from our list. The venture capital funds invest in various verticals, such as tech, biotech, food, consumer goods, and more.

1. Silverton Partners (Austin, USA)

Based in Austin, Texas, Silverton Partners is a leading US early-stage investor. The firm has a strong Texas focus and a successful track record. So far, Silverton has invested in more than 75 startups. Amongst the portfolio companies, more than 30 were acquired and 4 had an IPO. Portfolio companies include WP Engine, SailPoint, and TheZebra.

Update 2023: In January, the Austin-based VC investor announced a $8M investment in medical supply startup Rx Redefined. The investor is amongst others accompanied by Tusk Venture Partners.

Update 2024: Silverton Partners led another funding round in 2023, supporting cybersecurity company Enveedo with approximately $3.15 million.

2. Creandum (Stockholm, Sweden)

Creandum is a Swedish venture capital investor that is now active in various countries. The venture capital firm which was founded in 2003 can exhibit many successful investments, amongst others Spotify, Kry, or iZettle. Current portfolio companies include Timberhub (marketplace for timber) and Leapsome (Performance Management Software).

3. Viva Ventures Biotech Fund (Hong Kong)

The Hong Kong-based startup investor Viva Ventures Biotech is focused on investments in the life sciences sector. The fund is active since 2008 and focuses on early-stage investments. The sweet spot of the firm lies at the $10M discovery stage. Portfolio companies include Clues Therapeutics, Dogmar or Seraxis.

4. SuperSeed (London, UK)

Based in London, UK, Superseed is focused on supporting B2B software startups to “their first million”. The venture capital investor actively helps with their expertise to get sales traction and to realize the first million in revenue. Portfolio companies include Garvis, Finteum, and Techsembly.

5. Übermorgen Ventures (Zürich, Switzerland)

Übermorgen Ventures is a Swiss startup investor for early-stage climate tech startups. Target sectors include clean energy, food tech, green transportation, resource efficiency, and carbon capture. Portfolio companies include CleanHub, Sunvigo, Carbonfuture, and Ostrom.

6. Ambient Sound Investments (Tallinn, Estonia)

The Talin-based VC fund Ambient Sound Investments has its history and focus. It was launched by four engineers to hold their shares in Spotify. In 2005, the firm was converted to a family office-like fund that invests in startups with €200M AUM. The firm invests in seed and Series A startups as well as funds. Direct investments include Nanotronics, Frenzoo, and Pomelo.

7. bmp Ventures AG (Berlin, Germany)

The German venture capital investor BMP Ventures invests in tech companies with innovative business models. The firm has been active since 1997, has already launched 10 funds, made 250 investments, had 120 exits, and more than 20 IPOs. Portfolio companies include Vivoryon Therapeutics, Marketlogic, and Seraplant.

8. Passion Capital (London, UK)

Another successful global venture capital investor is the UK VC fund Passion Capital. The firm was launched in 2011, and since then it backed more than 93 tech startups. Portfolio companies include Tillo, tide, Sapi, and Nested.

9. Wittington Ventures (Toronto, Canada)

The Canadian venture capital fund Wittington Ventures invests in different sectors, such as healthcare, food, and e-commerce. Geographically, Wittington is focused on North America. Portfolio companies include Contentful, Gatik, and Thirty Madison.

10. Alaya Capital (Cordoba, Argentinia)

The Argentinian venture capital fund Alaya Capital invests in Latin American tech firms. The venture capital investor has, so far, launched 3 funds and invested in more than 30 startups. Current investments include Talently, Betterfly, Aquabyte, and Chattigo.

Picture Source: Daria Nepriakhina

Startup investment verticals of included VC funds

The global venture capital investors in our list are active in different verticals. We use our advanced keyword crawler technology to analyze the websites of included firms for dedicated keywords. In the following, we are highlighting certain focus lists that directly stem from our global list.

Software

Most startups and major innovations today are either software-enabled or even fully based on software. Startups work on cloud solutions, the digitalization of services and new, artificial intelligence-driven business models. We are highlighting the major VC investors in software startups.

CleanTech

CleanTech startups are working on solutions for a greener world with less emissions. Possible vertical areas are renewable energy, carbon capture or also energy efficiency. We are presenting the most important investors for innovative CleanTech firms in the world.

Biotech and Life Sciences

The biotech and life sciences sector works on new drugs and biotechnological ways to cure various illnesses. Startup investors in the sector are mainly dedicated biotech VCs, which are perfectly covered in our focus list.

AgTech

The agricultural sector plays a significant role in nurturing the world and providing food for more than 8 billion people. Startups in the AgTech sector work on indoor farming, sustainable agriculture, crop science and irrigation solutions. We are highlighting major AgTech investors.

Proptech

The building sector has immense challenges ahead: digitalization, sustainability and energy efficiency are main drivers of innovation and essential opportunities to revolutionize the branch. We have analyzed the most important proptech keyword-mentioning VC funds.

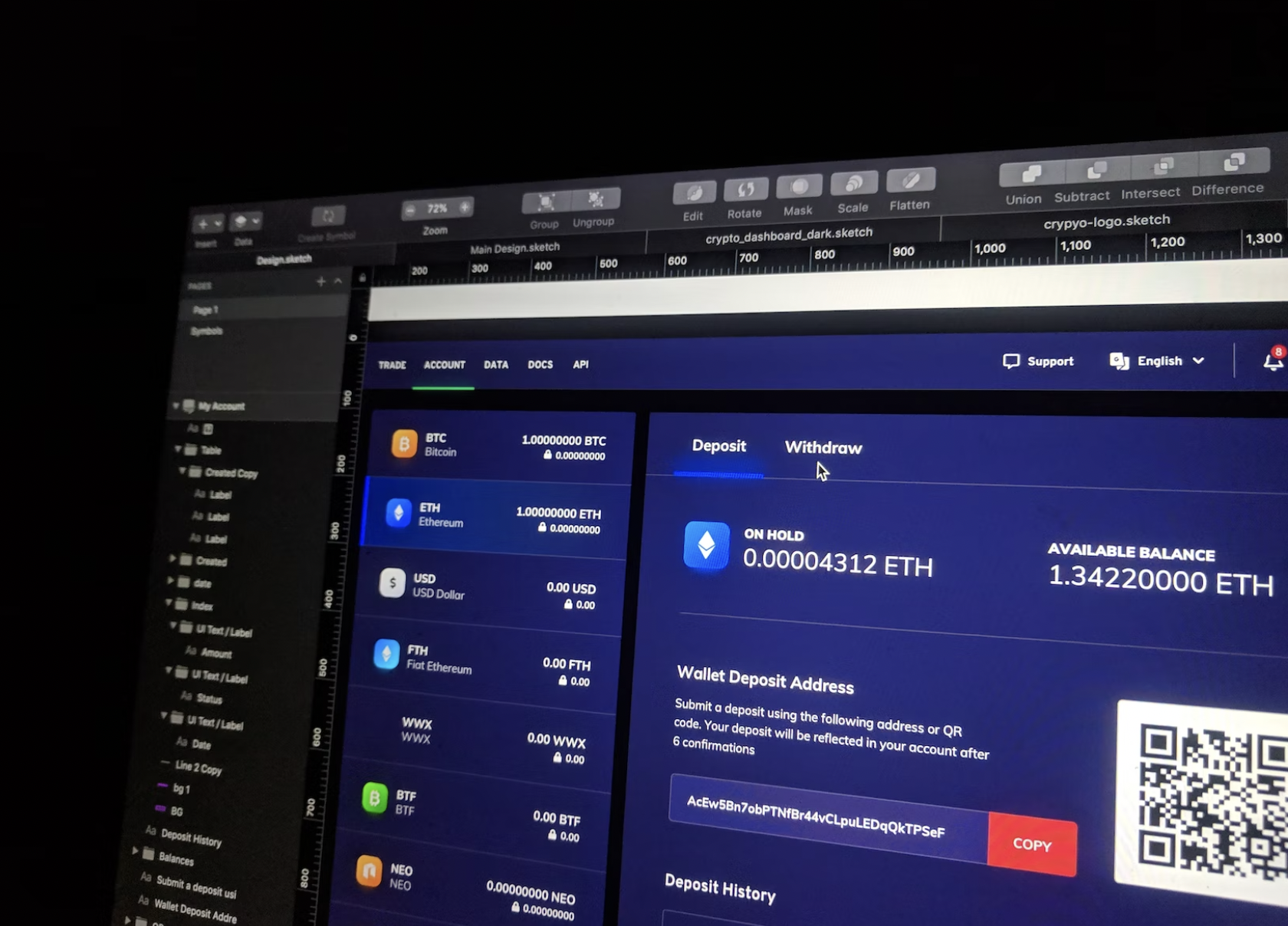

Cryptocurrencies, DeFI, Web3 & Metaverse

The crypto sector requires dedicated venture capital investors. We created a targeted focus list with investors that are actively mentioning verticals such as cryptocurrencies, Decentralized Finance, Web3 or the Metaverse on their website.

Included columns in our VC list

Our VC list is the perfect starting point to get in touch with the most important venture capital investors in the world. The list simply includes the most important columns for an overview.

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

- Investment focus-related keyword rates

What are the “investment focus-related keyword rates”?

One main advantage of our lists are the possibility to enrich them with keyword crawler related metrics. Therefore, we thoroughly crawl the website of every venture capital investor. Then, we count the occurrences of keywords, such as “biotech” or “life sciences”. Thereby, we can offer lists of perfectly matching investors for verticals such as biotech, agtech, travel or cleantech. You can find – and easily download – all our focus lists on our portfolio page.

What’s the best way to get in touch with the VC investors?

Many of our customers ask us how they should get in touch with the VC firms to pitch their product. One way surely is to simply send out standardized emails or your pitch deck to all of them. In most cases the email addresses are included in the list, and when you send your pitch out to more than 2,500 firms there should be an answer. However, that’s not the way we would recommend. Our customers made their best experience using the list to carefully select investors, maybe buy our keyword-crawler based target lists and then selectively get in touch with the VC investors via LinkedIn. Always helpful are similar connections that can give you an intro, or also meeting the investors first-hand at real world events.

But, no matter how you get in touch with them: our list is a must-have for every company, startup and advisor that wants to build up an extensive and reliable internal startup investor database.

Picture Source: Annie Spratt

![List of the 2,500 largest Venture Capital Investors [Update 2024] List of the 2,500 largest Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Global-VC-Investors-List-2.png)

![List of the 1,000 largest AI Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Artifical-Intelligence-Investors-List-2.png)

![List of the 250 largest Web3 Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Web3-Investors-List.png)

![List of the 900 largest Fintech Startup Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Fintech-Investors-List-1.png)

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png)

M Schwartz (verified owner) –

We are a UK private investment firm and look to expand our co-investor database and to get in touch with relevant venture investors. We were delighted about this simple, but highly useful list, to filter relevant VCs in our verticals. Highly recommended.

Richard DURAND (verified owner) –

The keyword statistics are useful. We hoped for personal contact details, but only general email addresses are included. But entries are really relevant. 4/5