Description

List of 5 large tech venture capital investors

The technology industry is defined essentially as the research, development, and distribution of technologically based products and services. The sector is often focused on electronics, software, and applications. This article highlights five large tech venture capital investors that are actively engaged in the sector.

1. Atomico (United Kingdom)

Atomico is a London-based international investment firm founded in 2006 that focuses on helping disruptive technology companies scale globally. Atomico has $5 billion of assets under management and has over 100 partnerships. Interesting companies from their portfolio are Klarna, a Swedish fintech company that provides online financial services with direct payments and post-purchase payments, and Skype, a proprietary telecommunication application.

2. IBB Ventures (Germany)

IBB Ventures was founded in 1997 and is located in Berlin. The firm invests in technology-oriented companies from the creative industries in Berlin. Their portfolio companies range from Consumer & Digital, Healthcare, Industrial Technologies, and Software & IT to Exit. An example portfolio company is Nuventura, which focuses on avoiding the emission of sulfur hexafluoride.

3. GreenPoint Partners (USA)

GreenPoint Partners backs founders in the technology, real assets, and sustainability realm. Some interesting portfolio companies are Snapdocs, who have developed a mortgage closing platform that is fast and convenient, ility, a SaaS platform for commercial property owners to create workplaces, and built an intelligent tool for construction and real estate financial management.

Update 2024: In 2023, GreenPoint Partners invested strategically in Semi-Stow, a semi-truck parking and trailer storage operator based in Austin, Texas. Additionally, GreenPoint launched a dedicated $500 million truck and trailer industrial outdoor storage platform.

4. Chiratae Ventures (India)

Since 2006, Ciratae Ventures has acquired $1B in assets under management and is, therefore, a leading VC firm in the technology sector. Currently, they are backing 125 ventures. One of them is a blockchain company named Chainflux, which is targeting sustainable solutions through traceability, transparent reporting, and tokenization.

Update 2023: The Indian VC investor announced a new funding round for CropIn, a Bengaluru-based startup working on predictive intelligence solutions in agriculture.

5. Monk’s Hill Ventures (Singapore)

Monk’s Hill Ventures was founded in 2014 and is interested in early-stage tech companies in Southeast Asia. They are located in Singapore, Vietnam, and Indonesia and have invested in over 30 startups in various tech sectors such as healthtech, fintech, edtech, e-commerce, cybersecurity, and HR tech. A portfolio company in the healthtech industry is Bot MD, a smartphone A.I. that provides doctors and other medical staff with answers to medical questions.

Picture Source: Umberto

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 4039) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.05) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „tech“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 2937) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.veloquence.capital/invest-in-startups/#mobile-menu) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.06) – highest keyword rate per subpage

- frequency_per_keyword: {‘tech’: 1456, ‘technology’: 2937} – dictionary of number of keyword occurrences per keyword

Picture Source: Ilya Pavlov

Results of our keyword analysis

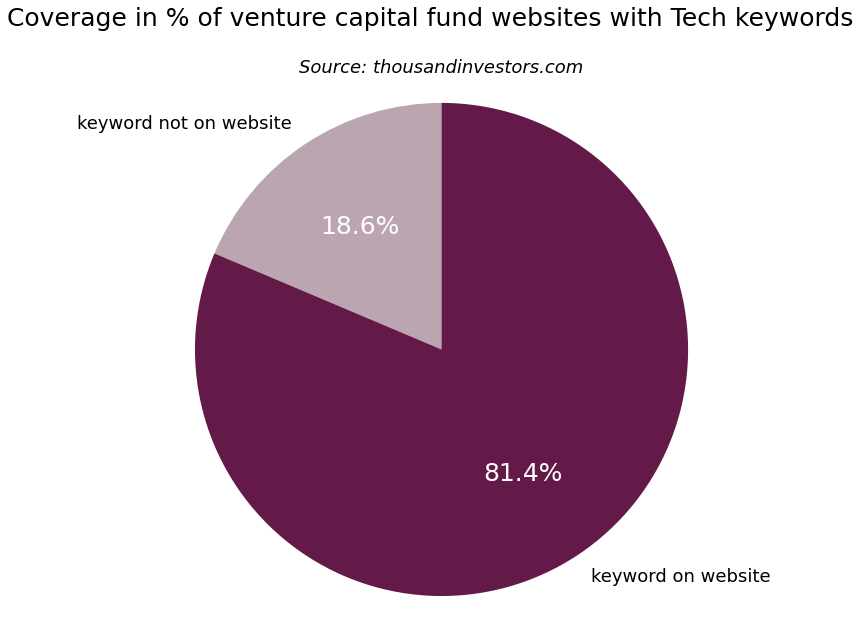

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

Percentage of VC funds that invest in start-ups in the tech sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding tech investment keywords. We found out that 81.4 % of the global VC funds mention technology.

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024] List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png?media=1715161852)

![List of the 1,500 largest Software Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Software-Investors-List.png?media=1715161852)

![List of the 400 largest Renewable Energy Technology Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Renewable-Energy-Investors-List-1.png?media=1715161852)

![List of the 250 largest Web3 Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Web3-Investors-List.png?media=1715161852)

![List of the 800 largest Travel Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Travel-Investors-List.png?media=1715161852)

Edmund (verified owner) –

Probably the most extensive and most up-to-date version of tech investors. Only a few points of information, but perfectly suitable for mailing campaigns and fundraising processes.