Description

List of 3 large software venture capital investors

Software has become essential in the modern world, as individuals and businesses rely on functioning operating systems and applications for daily tasks. The expenditure on enterprise software has the highest growth rate in the tech industry. This article highlights three significant venture capital firms from our VC list that are interested in the software industry.

1. JMI Equity (USA)

JMI Equity was founded in 1992 and has since then raised over $7.5 billion. They focus on supporting software companies with capital, advice, team-building, and strategies. The company is located in Baltimore, San Diego, and Washington, D.C. and their team consists of over 30 professionals. JMI Equity has invested in many different sectors, such as education, finance, digital health, and security. A portfolio company that focuses on cloud software is Adaptive Insights. Adaptive Insights provides cloud corporate performance management and business intelligence solutions.

Update 2023: JMI Equity’s portfolio companies stay on track. Bloomerang, one software startup investment of JMI, announced the hiring of a new CEO to fuel the company’s accelerated growth.

2. Seed and Speed GmbH (Germany)

The company Seed and Speed invests in B2B software startups in the pre-seed and seed phases. They usually invest up to €500T in the first round of funding and the total investment sum is up to €1m. Their portfolio consists of over 50 startups and one of them is Delicious Data, a software that uses artificial intelligence to help predict the exact amount of produce needed in order to minimize food waste.

Update 2024: Since 2023 the investment company has invested in Articly. Articly enables media users to consume quality journalism in the form of audio articles read aloud. Articles from leading German-language publications are selected, recorded by professional narrators, and made available on a subscription basis.

3. Raba (South Africa)

Raba is interested in building long-term investment partnerships with African software and internet companies in the early stages. A company that is part of their portfolio is mPharma, which developed software that focuses on digitalizing healthcare in Africa. Another portfolio company is AMMP, a software tool for renewable energy companies.

Picture Source: Markus Spiske

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 1110) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.03) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „software“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 2705) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.jmi.com/companies/#WORKFORCE MANAGEMENT) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.08) – highest keyword rate per subpage

- frequency_per_keyword: {‘software’: 274, ‘coding’: 4} – dictionary of number of keyword occurrences per keyword

Picture Source: Ales Nesetril

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

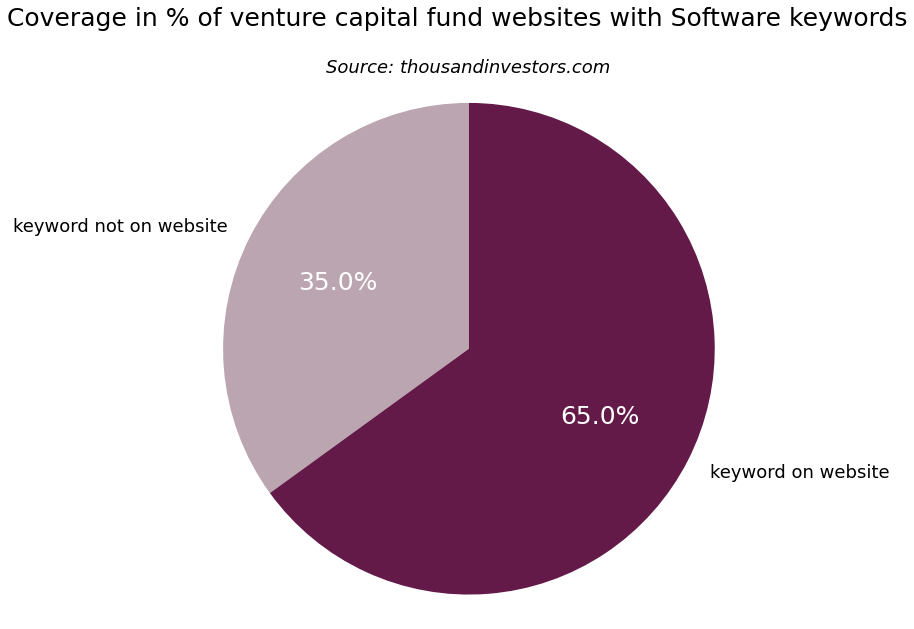

Percentage of VC funds that invest in software startups

Our keyword crawler analyzed more than 2,500 venture capital funds regarding software investment keywords. We found out that 65.0 % of the global VC funds mention software.

Focus on software

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword software to describe their VC company focus. Additionally, the term coding is used.

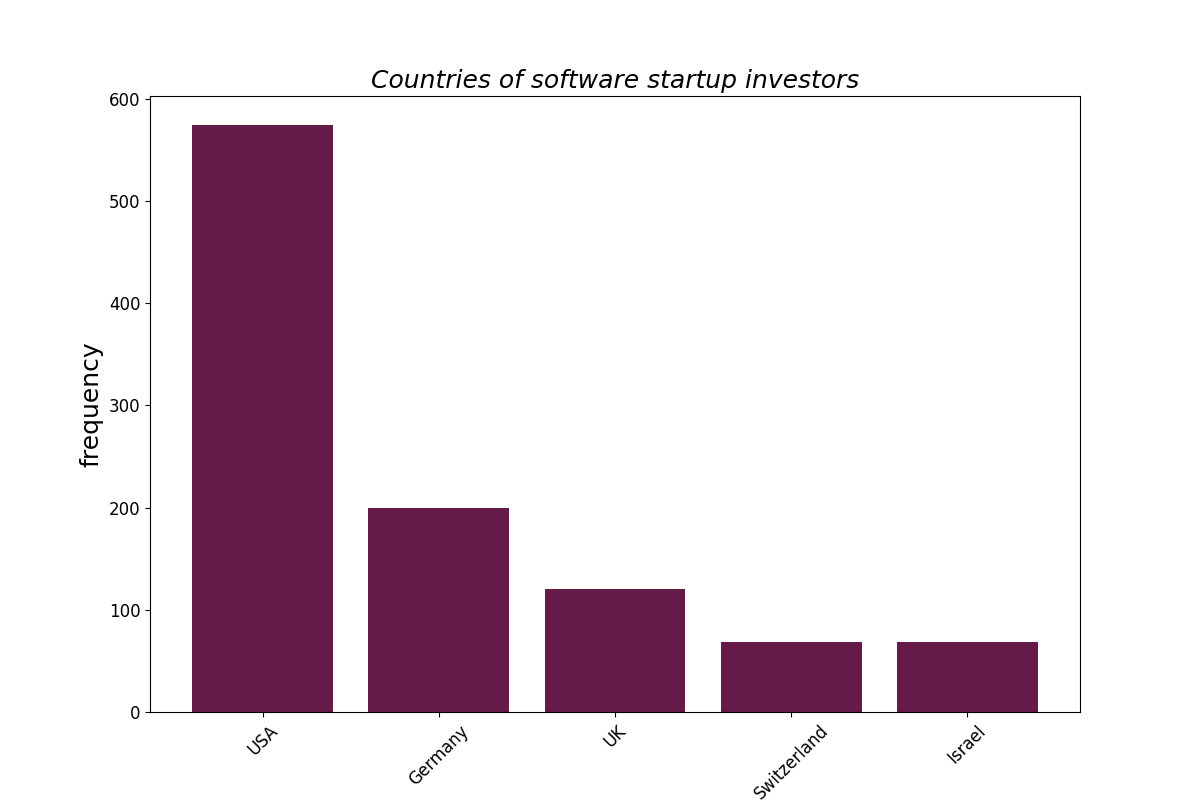

Countries of software startup investors

The most common countries for software startup investors are the USA. For instance, the previously presented investor JMI Equity is located in Baltimore, Maryland. Furthermore, countries like Germany, the UK, Switzerland, and Israel have also many software startup investors. These countries are known for their strong technology industries and high levels of innovation, which makes them attractive locations for startup investors looking for the next big thing. In addition, many of these countries have supportive government policies and favorable tax regimes for businesses, which can help software startups to grow and thrive. As a result, these countries are home to many successful software startups and are popular destinations for investors looking to invest in the technology sector.

![List of the 1,500 largest Software Venture Capital Investors [Update 2024] List of the 1,500 largest Software Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Software-Investors-List.png?media=1715161852)

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png?media=1715161852)

![List of the 100 largest Immunology Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Immunology-VC-Investors-List.png?media=1715161852)

![List of the 80 largest Vegan Food Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Vegan-Food-Venture-Capital-Investors.png?media=1715161852)

![List of the 300 largest Cleantech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/CleanTech-Investors-List.png?media=1715161852)

M Schwartz (verified owner) –

Like the other lists we ordered, high accuracy and perfectly matching investors.