Explore our list of the 700 largest biotech startup investors in the world – including Column Group The Column Group (TCG) has emerged as a prominent venture capital firm with an unwavering commitment to revolutionizing healthcare through its strategic investments in early-stage biotechnology companies. With an impressive $3.5 billion in assets under management, TCG is at the forefront of funding and constructing businesses that boast unique scientific platforms, which are not only groundbreaking but also promise to transform therapeutic solutions.

A Vision for Long-Term Value Creation

TCG’s investment philosophy sets it apart from the conventional quick-win approach seen in much of the venture capital world. With a clear understanding that true value within biotech startups takes time to cultivate, TCG adopts a long-term outlook when it comes to company development. This methodical strategy ensures that each portfolio company they invest in is built on solid scientific grounds with the potential to develop an extensive pipeline of treatments.

This patient and calculated approach is driven by the recognition that drug discovery is a complex and lengthy process. However, TCG’s dedication goes beyond mere patience; they actively participate in laying down strong foundations for their investee companies through their deep industry expertise.

Early-Stage Drug Discovery: A Fertile Ground for Innovation

At the core of TCG’s strategy is an emphasis on early-stage drug discovery—considered by many as the wellspring of innovative and effective therapies. The firm channels its resources into hand-picked enterprises, effectively concentrating pioneering ideas, world-class talent, and top-tier management into ventures capable of delivering substantial healthcare advancements.

The Column Group meticulously selects its portfolio companies, aligning itself with ventures that not only exhibit exceptional scientific potential but also meet significant unmet medical needs. By doing so, TCG ensures that its investments are positioned to make meaningful impacts on global health challenges.

The Ethos of Audacious Ambition

The ethos driving The Column Group is one marked by audacious ambition—an aspiration to back substantial ideas capable of significantly advancing healthcare solutions. TCG’s commitment transcends financial support; the firm brings together a synergy of scientific acumen, financial insight, and operational expertise to effectively guide their portfolio companies towards success.

Notable leaders from various successful biotech firms associated with TCG have lauded its relentless focus on science-driven initiatives and propensity for long-term company building—a testament to TCG’s comprehensive support system. Influential figures like Bill Rieflin (NGM), Richard Heyman (Aragon, Seragon & ORIC), Terry Rosen (Flexus & Arcus), and Nancy Thornberry (Kallyope) underscore The Column Group’s ability to not only catalyze powerful concepts but also foster enduring significance within their respective fields.

Building Lasting Contributors to Human Health

In essence, The Column Group stands out as a beacon in healthcare venture capital—supporting audacious projects poised to tackle pressing healthcare issues through stringent science and innovation. Their commitment extends beyond mere capital infusion; they invest time and expertise into shaping these companies into lasting contributors toward human health advancements.

Operating primarily within the United States, The Column Group has made a name for itself by precisely targeting early-stage drug discovery companies—the type that holds promise for both disruptive innovation and high returns on investment over longer periods.

In conclusion, The Column Group embodies a bold new wave in venture capital—one where foresight intertwines with finance and where revolutionary science meets steadfast support. For those invested in the future of biotechnology and healthcare innovation, keeping an eye on The Column Group’s movements could provide valuable insights into what tomorrow’s medicine might look like—and who will be leading its charge.

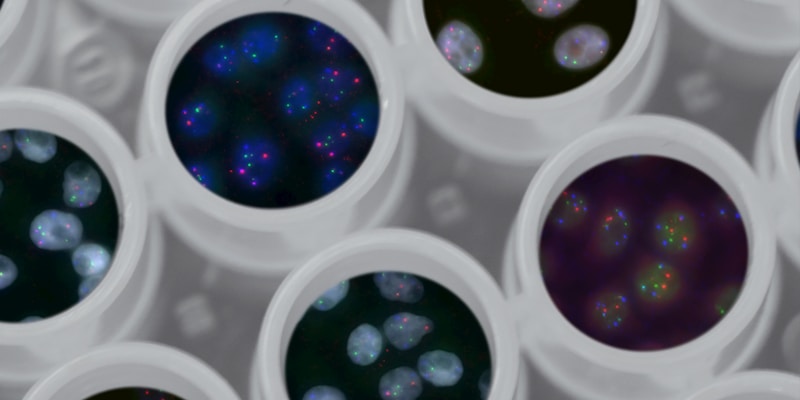

Picture source: CDC