Description

List of 5 large AI venture capital investors

By 2023, the global artificial intelligence (AI) market will be valued at around $515.31 billion. This rapid expansion is accompanied by a surge in AI startups worldwide, with the United States leading the way, home to approximately 15,000 AI-focused companies in 2023. This article describes five particularly active AI-focused venture capital investors.

1. Intel Capital (Santa Clara, USA)

Intel Capital, the venture capital arm of Intel Corporation, is a key player in advancing artificial intelligence (AI) technologies through strategic investments. With more than $193 billion in assets, Intel Capital is focused on driving AI innovation across multiple industries. Notable investments include companies such as Scale AI, which specialises in data labelling for AI applications, and Buildots, which uses AI to optimise construction management. These investments reflect Intel Capital’s commitment to supporting transformative technologies and integrating AI solutions across industries to shape the future of innovation.

Update 2024: In a recent development, Intel Capital led a $15 million investment in Buildots, a company that uses AI and computer vision to create digital twins of construction sites. This technology enables comprehensive on-site data collection, making it easier to track progress, identify bottlenecks and optimise workflows.

2. SST Engineering Ventures (Singapore)

ST Engineering Ventures (STEV) is the corporate venture capital arm of Singapore-based ST Engineering, a global technology, defense, and engineering group with operations across aerospace, smart city, defense, and public security sectors. Established in 2017, STEV manages a US$150 million fund dedicated to investing in early to growth-stage technology startups that align with ST Engineering’s strategic capabilities. The firm’s investment focus includes areas such as data analytics, cybersecurity, robotics, communications, IoT, cloud, autonomous technology, and other emerging technologies. In September 2024, ST Engineering Ventures invested in CloudSphere, a company that provides cloud governance and management solutions, helping businesses optimize cloud operations, enhance security, and ensure compliance across multi-cloud environments. Earlier in May 2024, they backed ARRIS, a materials technology firm that develops next-generation composite materials using 3D printing and automated manufacturing techniques, enabling lighter, stronger, and more sustainable products for industries like aerospace and automotive.

3. Partech Ventures (Paris, France)

Partech Ventures is a global investment firm focused on technology and digital companies, with offices in San Francisco, Paris, Berlin and Dakar. The firm invests at various stages, including seed, venture, and growth, with a focus on application software, deep tech software (data & AI infrastructure, cybersecurity, DevOps), B2B & B2B2C vertical platforms, and fintech & insurtech applications. Partech’s portfolio includes AI-driven companies such as Agicap, a cash flow management platform for SMEs, and Akeneo, a provider of product information management software. In recent years, Partech has raised nearly one billion euros to support technology entrepreneurs.

4. Kima Ventures (Paris, France)

Based in France, Kima Ventures is one of the world’s most active early-stage investors, focusing on technology start-ups, including those using artificial intelligence. The firm has invested in over 900 companies across multiple sectors, with a particular interest in AI-driven solutions. Kima Ventures’ portfolio includes companies such as Front, which uses AI to improve team collaboration and communication, and Algolia, an AI-powered search-as-a-service platform. While specific asset figures are not publicly disclosed, Kima Ventures’ extensive portfolio reflects its significant influence in the technology investment landscape.

5. Northzone (London, United Kingdom)

Northzone is a multi-stage venture capital fund dedicated to founders who challenge convention and create new markets, with a strong focus on AI investments. The firm has raised more than €1 billion, making it one of the largest funding rounds in Europe in recent years. Northzone’s portfolio includes AI-powered companies such as Einride, a freight mobility company that designs and builds technology for autonomous and electric transport systems, and Spring Health, which uses AI to help patients with mental health problems get better faster. These investments highlight Northzone’s commitment to advancing AI technologies across multiple industries.

Included information in our list

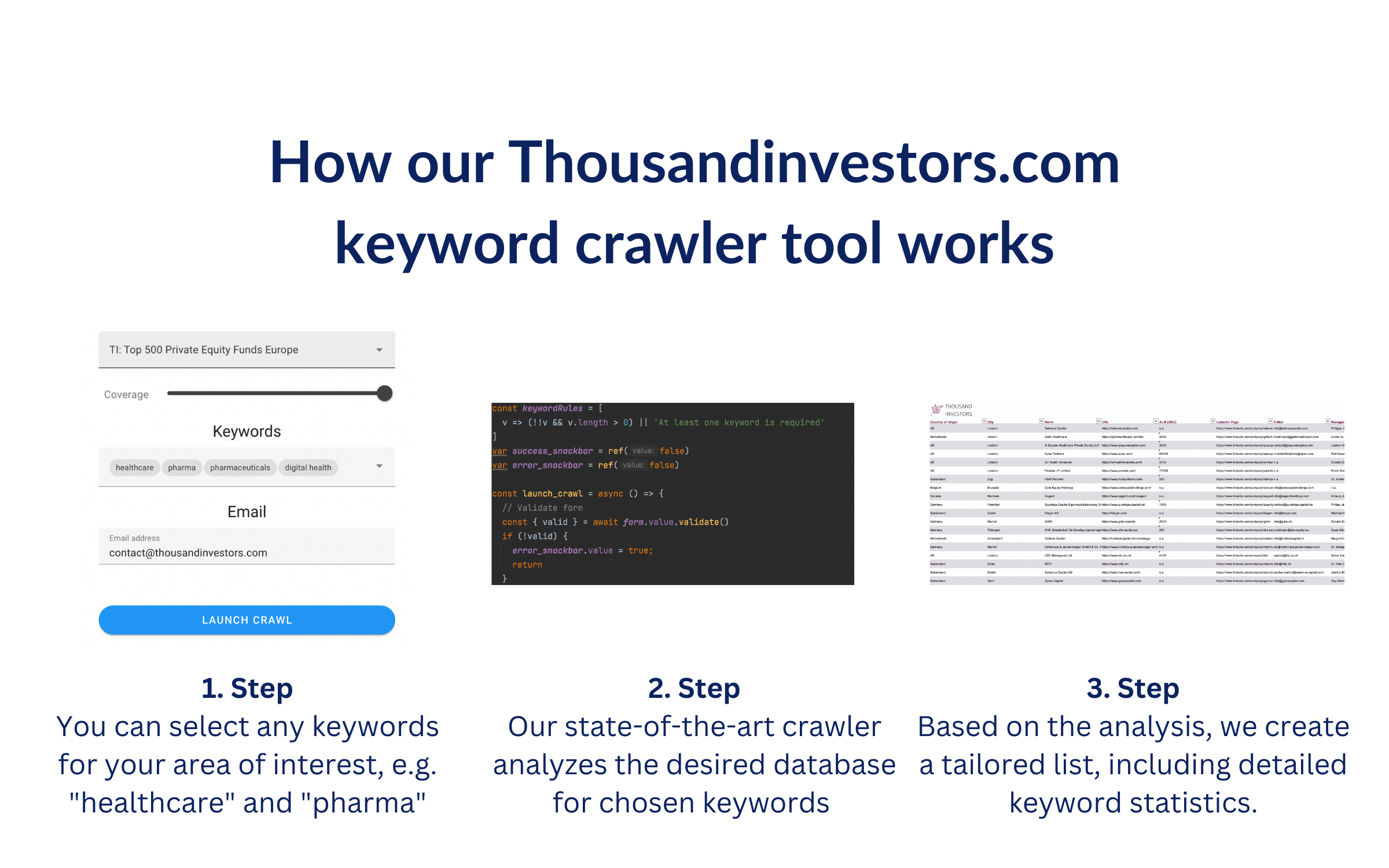

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 44) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.04) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „data science“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 42) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. http://www.inreachventures.com) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.04) – highest keyword rate per subpage

- frequency_per_keyword: {‘artifical intelligence’: 0, ‘data science’: 22, ‘neural networks’: 22} – dictionary of number of keyword occurrences per keyword

Picture Source: Desola Lanre-Olgun, Emile Perron

![List of the 1,000 largest AI Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/Artifical-Intelligence-Investors-List-2.png)

![List of the 1,500 largest Software Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Software-Investors-List.png)

![List of the 1,000 largest Food Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Food-Investors-List-1.png)

![List of the 900 largest Mobility Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/11/Mobility-Investors-List.png)

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png)

Guy Raymond (verified owner) –

Why didn’t we find this data set earlier? Great resource, highly recommended.