Description

List of 3 large crypto venture capital investors

In the following, we are introducing you to three interesting startup investors from our global crypto investor list who had an exceptionally high crypto keyword coverage rate on their page.

1. Block Ventures (United States)

Block Ventures already has a strong focus on crypto & co in its name: with a clear blockchain focus, the investor has been an early-stage investor since 2013. The US-based firm is active in the US and Middle East. The firm invests in initial coin offerings (ICOs), cryptocurrencies, and Apps. Portfolio companies include Metronome, QuarkChain, ONTology, and Ethereum.

2. G1 VC (UK)

Also G1 Ventures focuses on blockchain investments. The firm covers Seed to Series A investments, mainly in fintech projects in Western Europe. The firm started investing in 2014. The investment focus is described as a mix of applied decentralised protocols and blockchain-enabled businesses. Portfolio companies include Qredo, Kraken Delta Exchange, and IPOR. In May 2024, one of its investments, IPOR made it to one of the top derivative Ethereum protocols.

3. Pangea Fund (Switzerland)

Also, Pangea is an investment firm focused on “ventures, tokens, and projects related to blockchain tech”. The Swiss crypto investor has a Metaverse fund as well as a blockchain fund. The blockchain fund has invested in GoCrypto, Habitas and Chronicled.

Update 2024: In September 2023, Biodel Ag, Inc., a regenerative agriculture company, announced the closing of its Series A financing round. The round was led by Pangaea Ventures Ltd, a renowned venture capital firm with a focus on advanced materials and clean technology. The funding will support Biodel AG’s commitment to accelerating the commercialization of novel solutions aimed at enhancing soil health, optimizing water utilization, improving nutrient efficiency, and sequestering carbon emissions from the atmosphere.

Picture Source: Art Rachen

Included information in our cryptocurrency investor list

Our keyword analysis-based list include the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 16) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.1) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „crypto“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 10) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://venturecapitalinvestors.de/saas) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.1) – highest keyword rate per subpage

- frequency_per_keyword: {‘cryptocurrency’: 0, ‘crypto’: 828, ‘bitcoin’: 2078, ‘ethereum’: 0, ‘eth’: 1, ‘blockchain’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Milad Fakurian

Results of our keyword analysis

In the following, we are highlighting some interesting statistics of our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

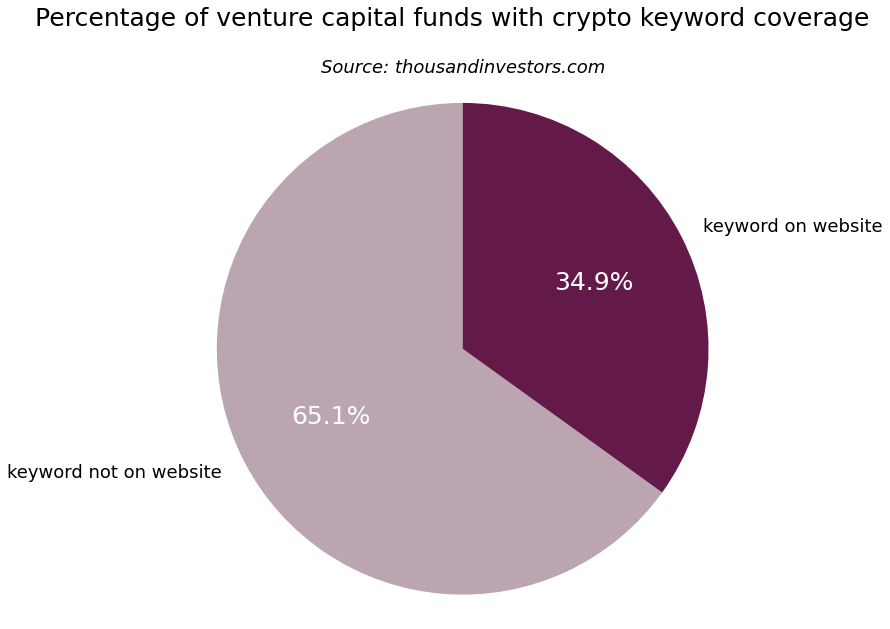

Percentage of VC funds that invest in cryptocurrencies

Our keyword crawler found out that out of 2,500 venture capital investors in our database, 34.9% are mentioning crypto-related keywords. Hence, we assume that about a third of VC funds are open for investments in startups in verticals such as cryptocurrencies, Web3, Metaverse and Decentralized Finance (DeFi).

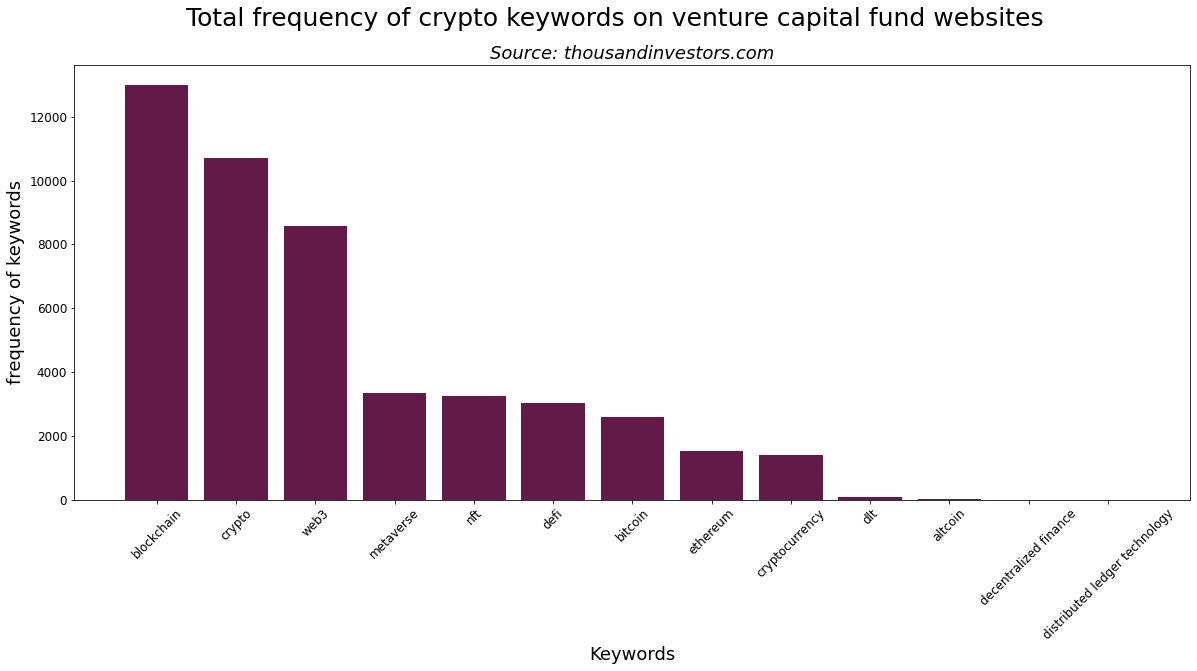

Focus on blockchain, web3, metaverse, NFTs, and DeFi

In the graph on the left, you can find the analyzed keywords and their occurrences. We can see that most VC funds mention the blockchain technology, followed by Web3 and Metaverse applications.

![List of the 700 largest Crypto Venture Capital Investors [Update 2024] List of the 700 largest Crypto Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/10/Thousand-Investors-Crypto-1.png?media=1715161852)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png?media=1715161852)

![List of the 1,000 largest AI Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Artifical-Intelligence-Investors-List-2.png?media=1715161852)

![List of the 80 largest Vegan Food Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Vegan-Food-Venture-Capital-Investors.png?media=1715161852)

![List of the 2,000 largest Tech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Tech-Investors-List.png?media=1715161852)

M Schwartz (verified owner) –

We are a UK private investment firm and look to expand our co-investor database and to get in touch with relevant venture investors. Although crypto is the most irrelevant investment vertical for us, we were impressed about the accuracy of the crawler