Description

List of 5 Large Biotech Venture Capital Investors

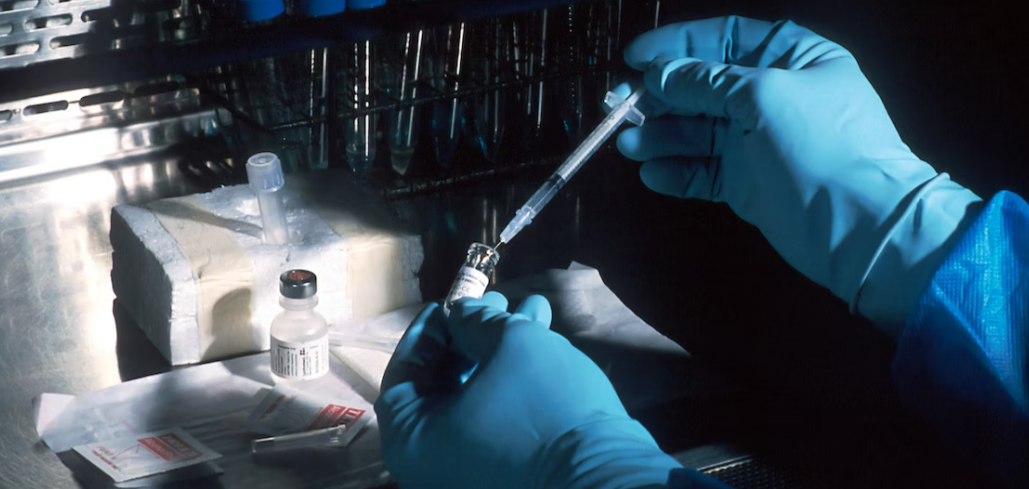

Biotech is one of the most important venture capital verticals, leading to breakthrough innovations in the pharmaceutical industry and saving lives. In the following, we are highlighting five different interesting venture capital investors from our keyword crawler-based list.

1. MPM Capital (United States)

With an average keyword rate of 6% per page, MPM Capital is leading our biotech-focused investor lists. The US-based venture capital investor is focused on early-stage funds. Its affiliate company BioImpact Capital follows with public equities and private/public funds. The US-based biotech investor has dozens of successful exits. For instance, Cellerant Therapeutics, which was focused on immunotherapy and blood-related illnesses; Dragonfly Sciences, which was focused on novel biosimilars, or Elixir Pharmaceuticals, which works on pharmaceuticals for metabolic illnesses. Current investments include Atkis Oncology (radiopharmaceuticals), Dyne Therapeutics (RNA-based therapies), or Harpoon Therapeutics (T-cell redirecting antibodies).

2. Sofinnova Partners (France)

Sofinnova Partners is a leading investor in healthcare startups. The French venture capital investor runs different strategies. Its “Capital Strategy” focuses on groundbreaking therapeutics in early-stage biotech companies. The fund also runs its own medtech accelerator and crossover investment strategies as well as “industrial biotech”. Portfolio companies include AAvantgarde Bio, which is working on adeno-based virus platforms for gene therapy applications. Portfolio company Delinia is a biotech firm working on T Cell-based therapies to cure autoimmune diseases and cancer. Their firm was acquired by Celgene. Inventiva, another portfolio company, is a clinical-stage firm based on small-molecule approaches against fibrosis, cancer, and lysosomal disorders.

Update 2024: Sofinnova Partners has appointed Andrew M. Weiss as a Venture Partner. Weiss is an experienced leader in the medical devices industry and has had ties to Sofinnova for 20 years. Based in San Francisco, Weiss will investigate investment opportunities in global medical devices across the Sofinnova Partners platform of strategies.

3. FJ Labs (USA)

FJ Labs is a venture capital firm and startup studio known for its diverse portfolio of investments, spanning various industries. While primarily focusing on technology, e-commerce, and marketplaces, FJ Labs has also made notable investments in the biotech sector, for example, 23andMe, a direct-to-consumer genetic testing and personal genomics company. Additionally, the company invested in Moderna Therapeutics who develop mRNA medicines, including the development of mRNA COVID-19 vaccines.

4. Matrix Partners (USA)

Since its establishment in 1977, the company has managed over 110 acquisitions. While Matrix Partners has a diverse investment portfolio, it has also invested in the biotech sector, backing visionary companies in healthcare and life sciences. One of them, for example, is Ginkgo Bioworks, a leader in synthetic biology. Ginkgo Bioworks engineers cells to produce high-value molecules for a range of industries, including pharmaceuticals, agriculture, and food.

5. Seroba Life Sciences (Ireland)

Also, Seroba Life Sciences is one of the top investors in our biotech list. The firm has dozens of successful exits and portfolio companies. For instance, Shorla Oncology is an Irish oncology pharma firm. Or, Coave Therapeutics is focusing on gene therapies. Whereas Atlantic Therapeutics works on neuromuscular stimulation devices.

Picture Source: National Cancer Institute

Why biotech VCs are different than many other early-stage investors

Biotech investors often accompany the young portfolio companies through several clinical trials. The investment managers from the biotech and life science segment often have a long career in research and/or the pharmaceutical business behind them. In addition to in-depth expertise in the respective research field, VCs also have comparatively large financial resources. Typical biotech funds are usually significantly larger than funds in the software or consumer goods sector. Exits are often in the billions.

Included information in our biotech investor list

Our keyword analysis-based list include the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 16) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.1) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „biotech“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 10) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://venturecapitalinvestors.de/biotech) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.1) – highest keyword rate per subpage

- frequency_per_keyword:{‘life sciences’: 0, ‘life science’: 0, ‘pharma’: 10, ‘pharmaceutical’: 7, ‘biotech’: 16, ‘clinical development’: 0, ‘drug development’: 0, ‘drug discovery’: 0, ‘oncology’: 73, ‘immunology’: 0, ‘mrna’: 1, ‘virology’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Hal Gatewood

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

![List of the 700 largest Biotech Venture Capital Investors [Update 2024] List of the 700 largest Biotech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Thousand-Investors-Biotech.png?media=1715161852)

![List of the 100 largest Immunology Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Immunology-VC-Investors-List.png?media=1715161852)

![List of the 400 largest Renewable Energy Technology Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/Renewable-Energy-Investors-List-1.png?media=1715161852)

![List of the 1,000 largest SaaS Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/12/SaaS-Investors-List.png?media=1715161852)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png?media=1715161852)

M Schwartz (verified owner) –

We are a UK private investment firm and look to expand our co-investor database and to get in touch with relevant venture investors. This is a brilliant list with the most relevant biotech VCs. The keyword crawler columns are significantly adding value.