We wrote this article while researching for our list of the 100 largest immunology startup focused venture capital funds. The list can be downloaded with a few clicks and includes the most relevant investors for immunology startups. We identified the included funds based on our sophisticated crawler technology and manual research.

Introduction to SNGLR Capital’s Investment Focus

SNGLR Capital stands out as an exponential tech-focused Venture Capital Fund, with a keen interest in early-stage technology startups that demonstrate the potential for exponential growth. Their investment strategy primarily targets European startups within the vitality, longevity, and smart mobility sectors. These startups are often at the forefront of technological innovation, leveraging advancements such as Artificial Intelligence (AI), Blockchain, Data Analytics (including IoT and API), 5G connectivity, Robotics, and other emerging technologies.

SNGLR Capital’s Approach to Supporting Startups

The team at SNGLR Capital is not just about financial investments; they are committed to working closely with entrepreneurs throughout their journey. This collaborative approach includes sharing experiences as founders, early-stage tech investors, board members, advisors, mentors, and coaches. Moreover, they have established a special engagement model that integrates Corporate Venture Units and Consulting Firms to provide strong market access and invaluable technology insights supported by their XLabs tech development gurus.

Geographical and Sectoral Investment Preferences

While SNGLR Capital mainly focuses on European markets for their investments, their reach extends through a global network of partners. They have shown particular interest in sectors where technology can make a significant impact on society’s well-being and efficiency – notably in healthcare-related fields like biotech startups or companies focusing on medical research and development.

The Team Behind SNGLR Capital

The diverse team at SNGLR Capital brings together individuals with deep expertise across various industries. Key team members include Klaus Kummermehr with his IT background following tech startup developments since 2010; Dr. Patrick Sutter with his legal expertise in Biotech Law; Dr.med. Eszter Tanczos who founded a biotech startup leading to a successful IPO; Trudi Haemmerli who is deeply engaged in the healthcare sector as an investor and coach; among others who bring rich experience from finance to automotive innovation.

Investment Criteria for Startups Seeking Funding

To be considered for funding by SNGLR XTF – the Seed fund arm of SNGLR Capital – startups should be developing technical solutions applicable within longevity or smart mobility/city sectors. The ideal candidate would utilize key technologies like AI, blockchain, IoT/AIoT (Artificial Intelligence of Things), robotics etc., which aligns with SNGLR’s vision of investing in businesses that harness innovative technologies for substantial societal impact.

Past Investments Reflecting Commitment to Immunology and Healthcare

Though there isn’t explicit mention of immunology-specific investments in the provided information about SNGLR Capital’s portfolio companies or investment history, it is evident through the professional backgrounds of team members like Dr.med. Eszter Tanczos that there is a strong inclination towards healthcare innovations which could encompass immunology startups given its close relation to biotechnology and medical research.

Contacting SNGLR Capital

If you’re looking to change the world with your startup idea within these sectors, visit SNGLR Capital’s website to submit your pitch deck or get more detailed information on how they can help support your entrepreneurial journey.

Conclusion: The Potential for Immunology Startups With SNGLR Capital

In conclusion, while direct investments in immunology startups by SNGLR Capital are not specifically mentioned in available data sources up until now (2023), their overall investment ethos suggests openness towards innovative health-tech ventures which could very well include those operating within immunology given its critical role in healthcare advancement.

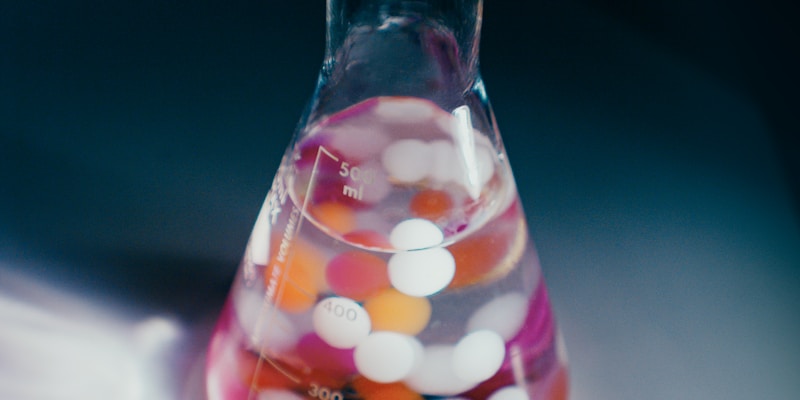

Picture source: Shridhar Gupta