Description

![List of the 90 largest Carve-Out Private Equity Investors Europe [2023] List of the 90 largest Carve-Out Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/nigel-tadyanehondo-3k5cAmxjXl4-unsplash-scaled.jpg)

List of 3 large European carve-out-focused private equity funds

Carve-out transactions in private equity involve the sale of part of a business, such as a division, a subsidiary, or certain assets, rather than the whole company. The carve-out process typically requires a corporate reorganization to separate the target business from the parent company. This involves negotiating which assets, liabilities, and contracts will be part of the deal and ensuring that the divested business is operationally ready to function independently after the transaction.

1. RCP Group GmbH (Munich, Germany)

RCP Group GmbH, a private equity firm based in Munich, Germany, specializes in alternative investments across various industries in Europe. The firm focuses particularly on special situations, including complex corporate carve-outs, unresolved successions, and turnaround situations. One notable transaction by RCP is the acquisition of Steel Automotive from Adient Group, completed on June 1st, 2023. Steel Automotive is a company that specializes in the development and production of high-precision stamped and formed metal parts. They serve blue-chip customers globally. This acquisition reflects RCP’s strategy to support and expand companies in dynamic markets, particularly in the automotive sector, which is undergoing significant transformation.

Update 2024: In 2023, the German private equity company completed the acquisition of Steel Automotive, a market leader in developing and producing innovative, high-precision stamped and formed metal parts. The acquisition was completed through a complex carve-out transaction.

2. Advent International Ltd (Boston, United States)

Advent International, based in Boston, USA, is a major player in the global private equity industry, with a track record of engaging in various transactions, including carve-outs. One of their recent notable activities was the acquisition of bareMinerals, BUXOM, and Laura Mercier from Shiseido Americas. This transaction demonstrates Advent’s expertise in both the beauty sector and executing complex corporate carve-outs. Advent has a rich history of investing in diverse sectors, such as retail, consumer and leisure, business and financial services, healthcare, industrial, and technology.

3. Duke Street LLP (London, United Kingdom)

Duke Street LLP is a private equity firm based in London that has been investing in mature, mid-market Western European businesses for over twenty years. Their investment focus is on four key sectors: Consumer, Healthcare, Industrials & Engineering, and Services. Duke Street typically targets companies with an enterprise value ranging between £50 million and £250 million. With regards to their Carve-Out-related transactions, Duke Street has been involved in several significant deals. In July 2018, the firm acquired Great Rail Journeys, a tour operator that offers escorted worldwide rail tour holidays, for approximately £100 million.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

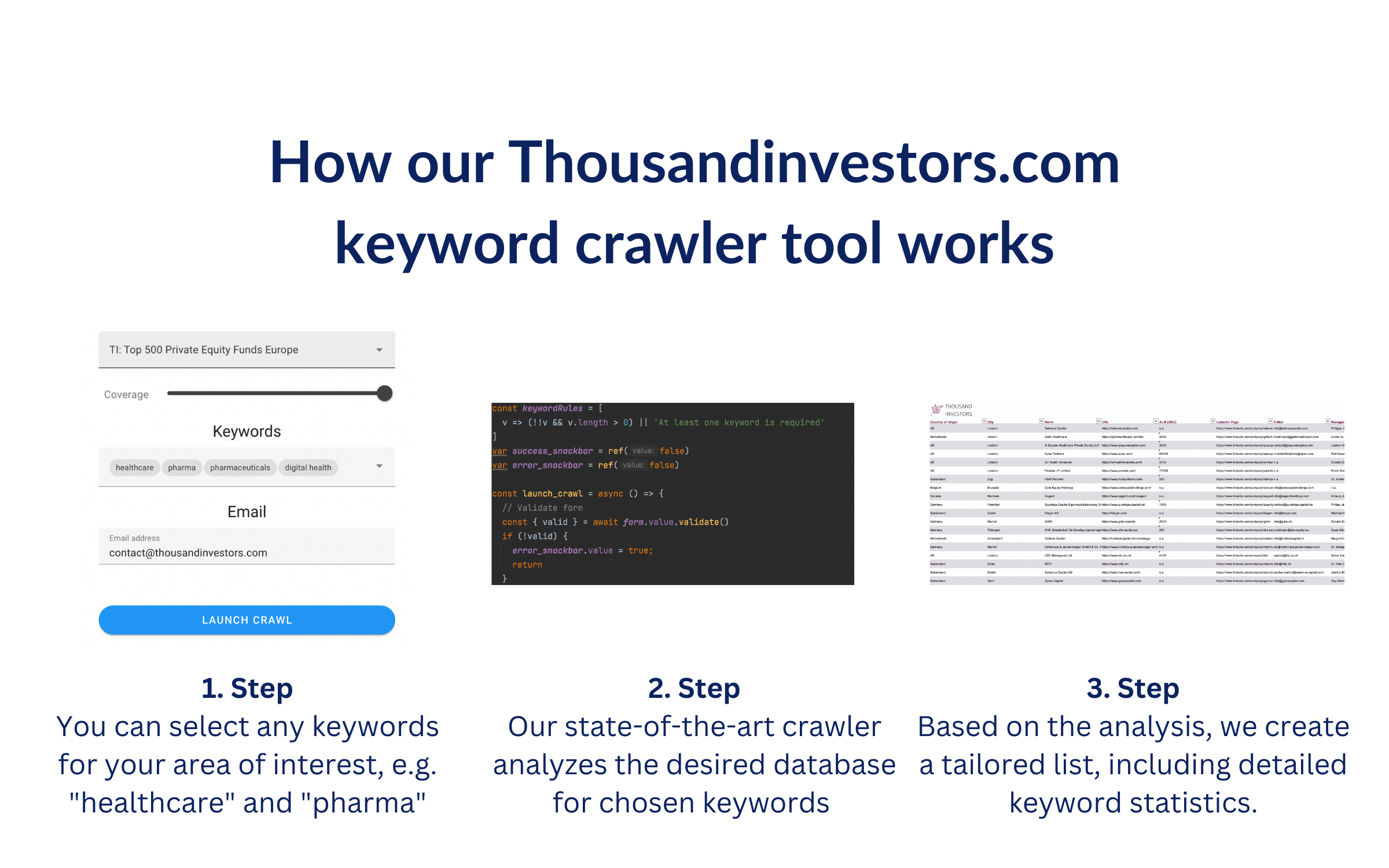

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keywords “Carve-Out“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024] List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Investors.png)

![List of the 90 largest Carve-Out Private Equity Investors Europe [2023] List of the 90 largest Carve-Out Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Europe.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

![List of the 150 largest Renewables Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Renewables-Private-Equity-Investors.png)

Reviews

There are no reviews yet.