Description

List of 3 large European renewables-focused private equity funds

The renewables sector is getting increasingly important for European investment managers that are either acquiring solar and wind parks directly or acquiring stakes in renewable energy firms. We are introducing you to three exciting renewable energy private equity investors from our list in the following.

1. Actis (London, UK)

The London-based private equity firm Actis call itself the “leading global investor in sustainable infrastructure”. The firm manages more than $24bn and was founded in 2004. Focus sectors of actis are energy infrastructure, long life infrastructure, digital infrastructure, real estate and private equity. Current investments in the energy sector include Zuma Energia, Yellow Door Energy or Valia Energia. The latter is a 2.2GW buy-and-build electricity generation platform. Another investment, Rezolv Energy, is a clean power producer launched in 2022, with focus on central and south eastern Europe. For instance, the firm signed an agreement to develop 1GW of wind projects.

Update 2024: In late 2023, Actis, a British private equity firm, completed its initial real estate divestment in Vietnam. An Phat Holdings has acquired the 49% of the investment previously held by Actis, their operating partner.

2. Everwood Capital (Madrid, Spain)

The Madrid-based investment manager Everwood is a leading renewables private equity investor. The firm has €450M assets under management and was incorporated in 2015. Within its renewables verticals, the firm invests in solar parks in Southern Europe, for instance in Spain, Portugal or Italy. The recently launched fund IV focuses on follow-up PV investments in southern Europe. For instance, the firm invested in a 50MW solar park in Escatron, Spain.

3. iAM Capital (London, UK)

Also London-based private equity firm iAM Capital focuses on real estate and renewable energy. The firm has acquired 50MWp of solar plants so far. Past investment include the “Apollo Portfolio” in Italy with 34.5MWp, or the UMJA Portfolio in Italy with 3.5MWp power. The firm plans to grow within the renewables sector in coming years.

Picture source: Unsplash+

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Emile Perron

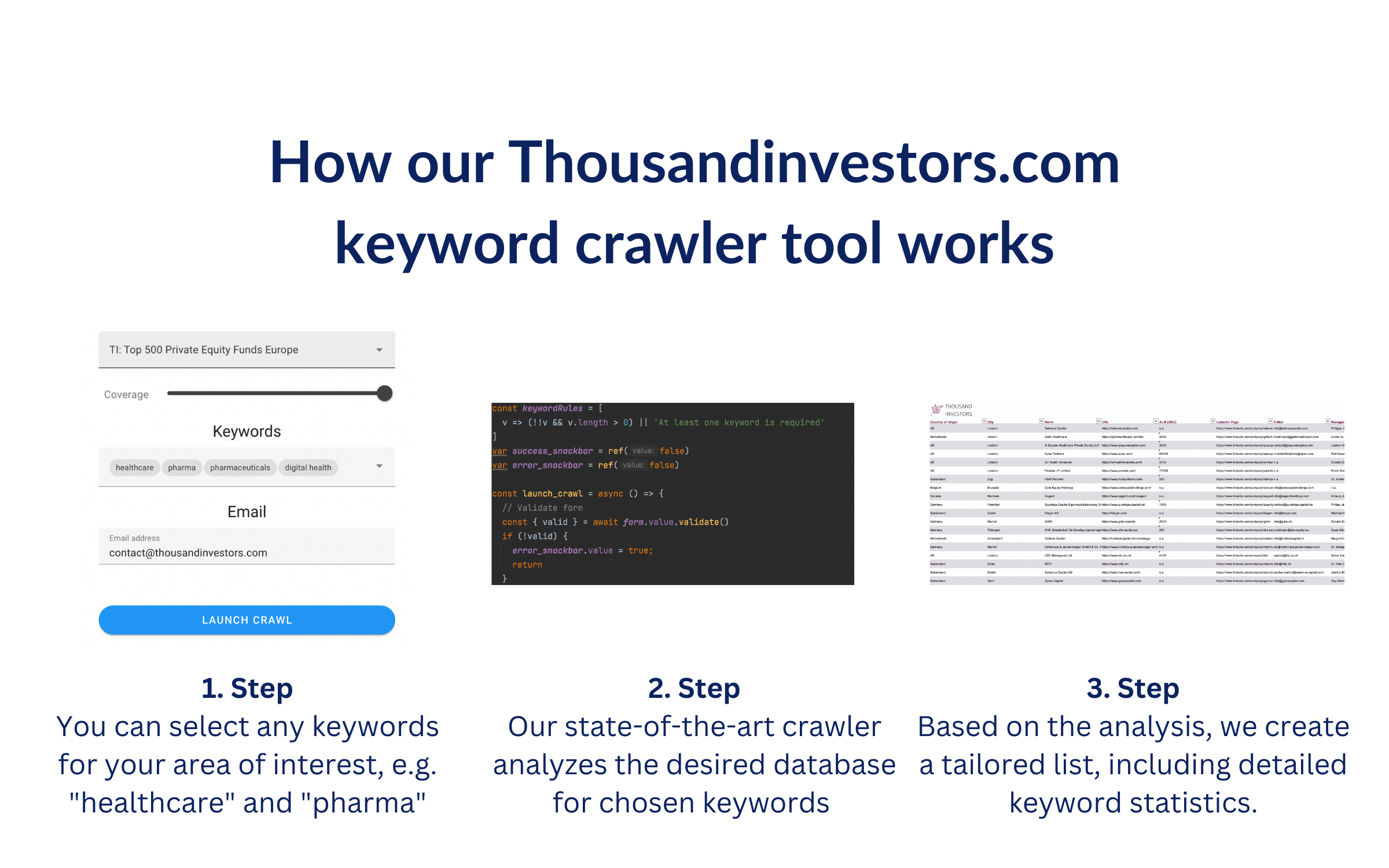

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “renewable energy”, “renewables”, “solar energy”, “wind energy”. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 150 largest Renewables Private Equity Investors Europe [Update 2024] List of the 150 largest Renewables Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Renewables-Private-Equity-Investors.png)

![List of the 90 largest Carve-Out Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Carve-Out-Private-Equity-Investors.png)

![List of the 50 largest Climate Tech Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Climate-Tech-Private-Equity-Investors.png)

![List of the 500 largest Private Equity Funds Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Europe.png)

![List of the 300 largest Consumer Goods Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Consumer-Goods-Private-Equity-Investors.png)

Suzanne L. (verified owner) –

The renewables market is just picking up speed, so we have been looking for new investors. This list is extremely valuable for us.