Description

List of 3 large European healthcare focused private equity funds

We have analyzed our extensive private equity database with the help of our keyword crawler to identify the most important private equity funds that invest in healthcare companies. In the following, we introduce you to three companies from our list.

1. Gilde Healthcare (Utrecht, Netherlands)

Dutch private equity fund Gilde Healthcare Partners already has the “healthcare” focus in its name. The firm belongs to Europe’s most active healthcare private equity investors, focusing on healthcare providers, medical product manufacturers, and service providers. Exemplary portfolio companies include diagnostics and clinical-trial services firm Viroclinics Biosciences or Chr. Diener, which manufactures medical instruments.

Update 2024: In January 2024, Gilde Healthcare, a Dutch private equity company, announced the acquisition of Calypso. Gilde had acted as the lead investor in Calypso’s first financing round, which was acquired by Novartis.

2. G Square Healthcare Private Equity (London, UK)

Also G Square already has the “healthcare” focus in its name. The firm, founded in 2008, manages over €2BN, targeting PE investments in European healthcare firms. One portfolio company is Dutch dental care provider Denteam. In France, G Square invested in nursing home chain Medicharme.

3. Telemos Capital (London, UK)

The London-headquartered fund Telemos was initiated in 2017, funded by a family office. The PE fund focuses on €50-200M investments in majority stakes of companies. One main investment vertical of Telemos is called “healthcare services”. Exemplary investments are Stringray Healthare, which operates cancer treatment centers, or MedEuropa, that operated radiotherapy clinics in Romania.

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Unsplash+

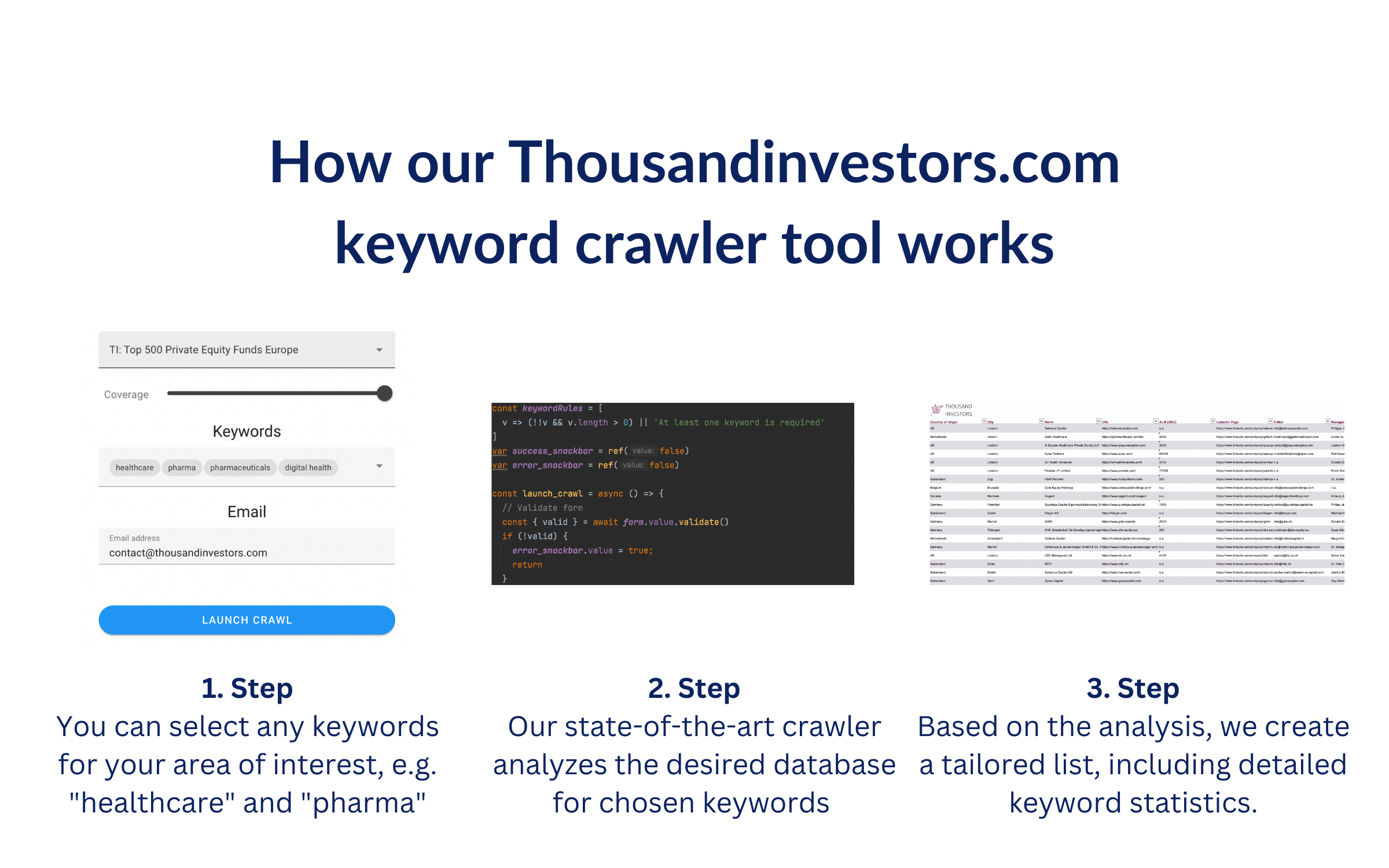

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “healthcare“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 300 largest Healthcare Private Equity Investors Europe [Update 2024] List of the 300 largest Healthcare Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Healthcare-Private-Equity-Investors-1.png)

![List of the 150 largest Renewables Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Renewables-Private-Equity-Investors.png)

![List of the 350 largest Software Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Software-Private-Equity-Investors.png)

![List of the 300 largest Infrastructure Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Infrastructure-Private-Equity-Investors.png)

![List of the 150 largest Sports Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Sports-Private-Equity-Investors.png)

Reviews

There are no reviews yet.