Description

![List of the 130 largest Succession Private Equity Investors Europe [2023] List of the 130 largest Succession Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/hunters-race-MYbhN8KaaEc-unsplash-scaled.jpg)

List of 3 large European succession-focused private equity funds

Succession planning in private equity is a vital process that guarantees the durability and stability of leadership in an organization. Furthermore, it encounters distinct challenges owing to the industry’s dynamics. For instance, the typical length of tenure for a CEO at an S&P 500 company is approximately ten years. However, in companies backed by private equity, transformational efficiencies must be achieved within much shorter periods. Succession planning in this sector is a comprehensive and ongoing process that demands strategic vision, detailed preparation, and a dedication to cultivating leadership and talent within the organization.

1. ECM Equity Capital Management GmbH (Frankfurt, Germany)

ECM Equity Capital Management GmbH, located in Frankfurt, Germany, is a private equity firm established in 1995. The firm concentrates on investing in medium-sized enterprises, with a focus on companies in the German-speaking region that have prospects for growth and development. The majority of investments are made by the company, which specializes in this area. ECM’s investment strategy encompasses a broad range of scenarios, such as succession planning, corporate spin-offs, partnerships with entrepreneurs, growth financing, changes to the shareholder structure, and complex special situations. In cases of succession planning, ECM has a track record of supporting management buyouts, as demonstrated by their involvement with DETAX and other companies.

2. IceLake (Amsterdam, Netherlands)

IceLake has significant expertise in handling entrepreneurial succession, international expansion, and acquisitions. The investment company has devised mechanisms that empower corporations to expediently apply the best measures to enhance and construct the structure and procedures that underpin the advancement of the enterprise. IceLake has extensive expertise in entrepreneurial succession management, international expansion, and buy & build. Moreover, IceLake Capital has designed tools that help businesses swiftly implement optimum practices to enhance and construct their organizational and process capabilities to foster business growth.

Update 2024: Since 2023, the Interduct Group has been invested in by the Dutch private equity firm, Ice Lake. Inderduct is renowned for its proficiency in indoor climate technology. The Amsterdam-based private equity firm is supporting the business to achieve organic growth.

3. H2 Equity Partners Ltd. (London, UK)

H2 Equity Partners, established in 1991, is a leading investment company in Western Europe that concentrates on the United Kingdom, Ireland, and Benelux areas. Their area of expertise lies in investing in mid-sized firms that show substantial growth or betterment potential. They usually target firms with a yearly revenue range of €25 million to €550 million. H2 Equity Partners offers practical assistance by collaborating with management teams to execute ambitious plans more efficiently and expeditiously. They engage in several transactional types, such as corporate carve-outs, growth and profit enhancement initiatives, and special circumstances.

Picture source: Unsplash

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds help to get in touch with the executives and investment managers of the included firms.

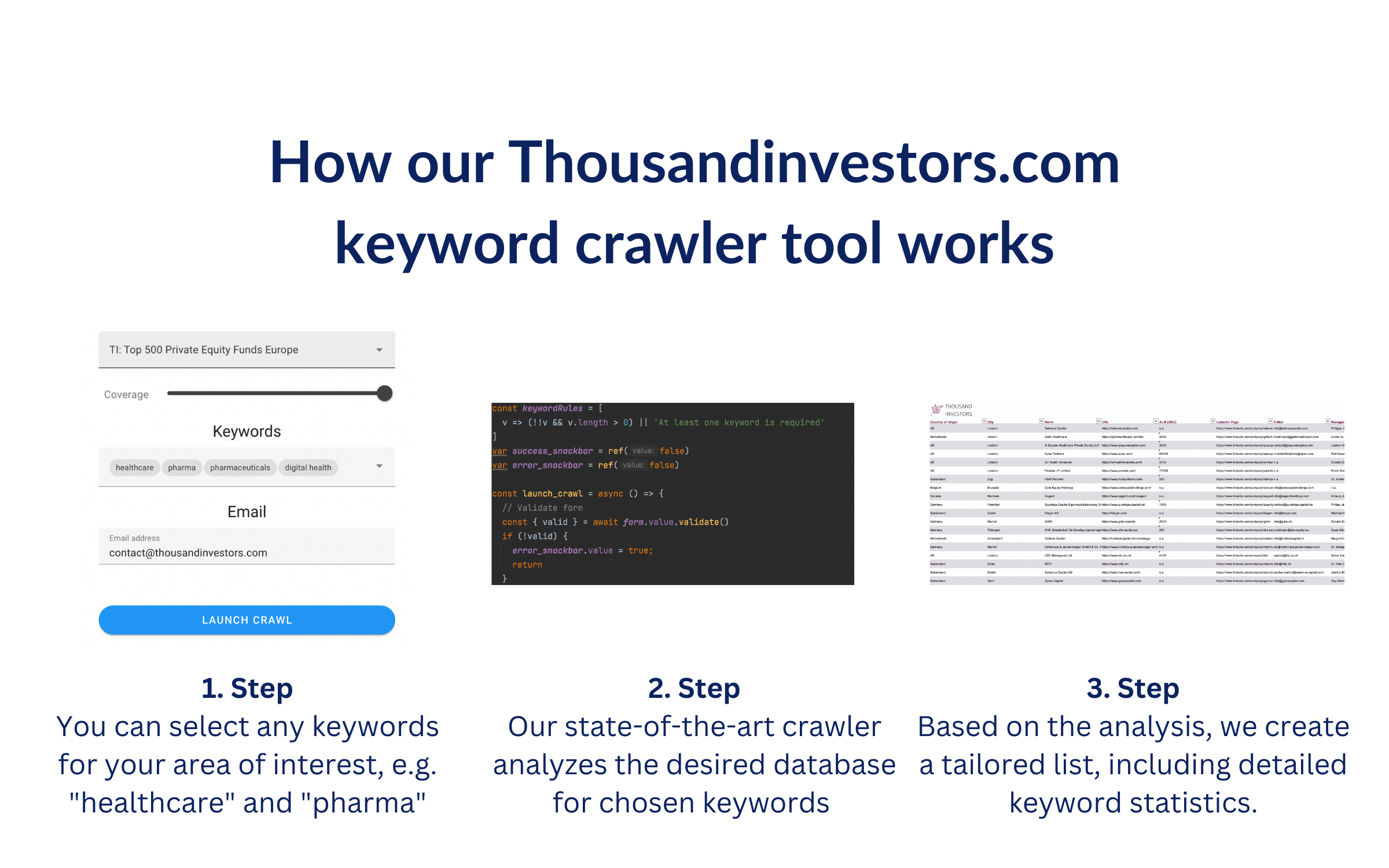

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “Succession“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords were found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 140 largest Succession Private Equity Investors Europe [Update 2024] List of the 140 largest Succession Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Succession-Private-Equity-Investors.png)

![List of the 190 largest Private Equity Funds UK [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-UK.png)

![List of the 30 largest Private Equity Funds in Belgium [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Private-Equity-Funds-Belgium.png)

![List of the 350 largest Software Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Software-Private-Equity-Investors.png)

![List of the 40 largest Hydrogen Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/11/Hydrogen-Private-Equity-Investors.png)

Reviews

There are no reviews yet.