Description

List of 5 large European software focused private equity funds

The European software market is expanding quickly, also driven through novel artificial intelligence-based applications and the uprise of cloud businesses. In this article, we are introducing five interesting software-focused private equity funds from our list.

1. Permira (London, United Kingdom)

Permira is a global investment firm with a strong focus on software and technology investments. Originally founded in Europe in 1985 as Schroder Ventures, the firm was rebranded as Permira in 2001. With over 500 professionals in 16 offices across Europe, the US and Asia, the firm has a significant global presence. Permira’s buyout, growth equity and credit funds have approximately €80 billion of committed capital and have backed over 300 companies through multiple economic cycles. With over 35 years of experience, Permira has built a reputation for driving growth and innovation, particularly in the software sector, where it leverages its deep industry expertise to support transformational businesses.

Update 2024: In May 2024, Permira announced the acquisition of Squarespace, a website creation platform, in an all-cash transaction valued at approximately $6.9 billion.

2. EQT Partners (Stockholm, Sweden)

EQT Partners is a global investment firm with a 30-year track record of driving growth in various sectors, including software. Renowned for its focus on innovation and sustainability, EQT invests in transformative technologies such as cloud-based solutions, AI and automation. With funds in Private Equity (€125-1.5 billion), Growth Capital (€50-200 million) and Healthcare, EQT manages more than 250 portfolio companies globally. Its strategic approach focuses on future-proofing businesses and creating long-term value through innovation and digital transformation.

3. Main Capital Partners (Antwerpen, Netherlands)

Main Capital Partners is a leading software investor with over 20 years of experience in enterprise software, focused on Northwest Europe and North America. Offering equity tickets ranging from €5 million to €150 million, the firm accelerates growth, internationalises businesses and drives innovation through strategic organic expansion and buy-and-build strategies. By fostering partnerships and profitably scaling software companies, Main Capital Partners contributes to the broader software ecosystem, creating long-term value and positive societal impact.

4. Kennet Partners (London, United Kingdom)

Kennet Partners is a growth equity firm with over 25 years of experience in the B2B software sector, specialising in high-growth, capital-efficient companies. In July 2024, Kennet closed its sixth fund, Kennet VI, raising €266 million – the largest in its history – bringing total assets under management to over €1.3 billion. The fund has already been deployed in investments such as Screendragon, a SaaS workflow automation platform (€25 million investment), and Fluid Topics, an AI-driven content delivery solution provider. Kennet has a reputation for backing bootstrapped software companies, providing the capital needed to scale internationally and build high-performing management teams.

5. AnaCap Financial Partners Limited (London, United Kingdom)

Founded in 2005 and based in London, AnaCap Financial Partners specialises in software, technology and services within the European financial ecosystem. With $5.1 billion of assets under management, AnaCap focuses on lower middle market companies, driving growth through partnerships with entrepreneurial management teams. In 2024, AnaCap entered into exclusive negotiations to acquire Cleva, a leading provider of insurance software solutions, further strengthening its position in the financial technology sector.

Picture source: Emile Perron

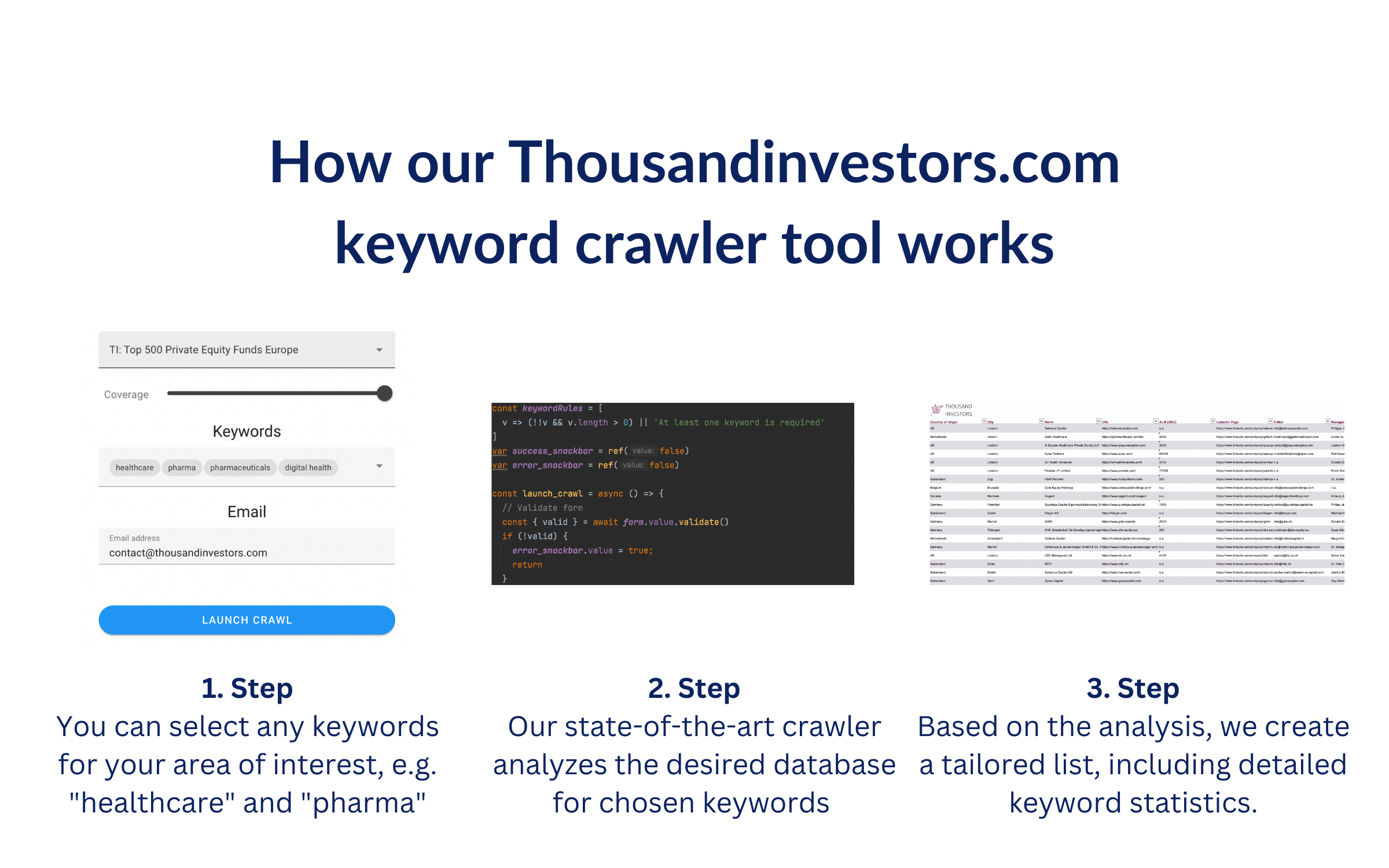

Columns included in our list

Through our list, you can get an overview of the most important private equity investors. In detail, the list offers the most important data points to get in touch with the most important private equity funds:

- Name

- Country of Origin

- City

- URL

- General E-Mail (if available)

- LinkedIn Page (if available)

- Managing directors (if available)

- Assets under Management in €M (approximation, if available)

- Geographic focus (office locations)

Especially the LinkedIn pages of the PE funds helps to get in touch with the executives and investment managers of the included firms.

Picture source: Emile Perron

This list is based on our sophisticated keyword crawler technology. We crawled the websites of all private equity funds in our European private equity database for the keyword “software“. We crawled every website for at least 60 seconds. The offered list includes all PE funds in Europe that mentioned the keywords for at least one time. The list includes detailed keyword statistics, e.g. the number of keyword occurrences, which keyword occurred how often, where most keywords where found, etc. Thereby, it helps you to identify the most relevant investors in the respective vertical.

![List of the 350 largest Software Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Software-Private-Equity-Investors.png)

![List of the 350 largest Software Private Equity Investors Europe [Update 2025] - Image 2](https://www.thousandinvestors.com/wp-content/uploads/2023/06/PE-Software-Investors.png)

![List of the 250 largest Food Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/06/Food-and-Beverage-Private-Equity-Investors.png)

![List of the 60 largest Industrial Technology Private Equity Investors Europe [2023]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Industrial-Technology-Private-Equity-Investors.png)

![List of the 140 largest Succession Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Succession-Private-Equity-Investors.png)

![List of the 80 largest Spin-Off Private Equity Investors Europe [Update 2024]](https://www.thousandinvestors.com/wp-content/uploads/2023/12/Spin-Off-Private-Equity-Investors.png)

Mark Henderson (verified owner) –

Great resource, best list I ever bought online