Description

List of 3 large food venture capital investors

The food industry is a vast sector that focuses on the supply, development, distribution, and logistics of food-related products. Farming, agtech, and foodtech are also part of the industry. This article highlights three food venture capital investors who are interested in startup investments in the sector.

1. Tyson Ventures (USA)

Tyson Ventures is the investment arm of Tyson Foods. It invests in early-stage projects that focus on providing sustainable nutrition to the global population. Currently, it mainly supports businesses targeting emerging proteins, technology, and sustainability. A promising company in its portfolio is Future Meat, which grows meat from high-quality, non-GMO animal cells in a lab.

2. Eatable Adventures (Spain)

Eatable Adventures is a VC that has a €50M fund targeting foodtech startups in Europe and Latin America. Altogether, the company has supported over 25,000 startup founders and entrepreneurs, and per year, they evaluate over 2,400 projects. One of them is Ekonoke, a sustainable and reliable solution for climate-resilient agriculture.

Update 2024: In 2023, Eatable Adventures was selected by CDP Venture Capital’s national network of accelerators to lead FoodSeed, the national Agrifoodtech acceleration program. FoodSeed will become part of the national network of accelerators for Italian public venture capital, which already has nearly 20 specialized programs to support the development of the most innovative Italian agrifood startups.

3. Wittington Ventures (Canada)

Wittington Ventures is a Canadian VC investor focusing on technology startups in e-commerce/retail, healthcare, and the food sector. An exciting portfolio company is Brave Health, a telehealth-enabled mental health care provider. Another is Motif Foodworks, which is developing plant-based alternatives to conventional food products.

Picture Source: Hermes Rivera

Included information in our list

Our keyword analysis-based list includes the following general columns:

- Name of the VC fund

- Country of origin

- URL

- E-mail (general)

- Investment focus (if data available)

- Corporate VC (yes/no)

The following columns are based on the keyword crawler, which is a Python-based, in-house developed tool that crawls every page for at least 45 seconds to find the respective keywords.

- total_frequency (e.g.: 4173) – total counted occurrences of keywords on the VC website

- average_keyword_rate (e.g. 0.16) – average rate of keyword occurrences per subpage in relation with total number of words

- most_common_keyword (e.g. „food“) – keyword that was counted the most often on respective VC website

- most_common_keyword_frequency (e.g. 3478) – number of times the most common keyword was counted

- sub_url_highest_rate (e.g. https://www.spventures.com.br/esgeng) – sub url with the highest number of found keywords

- highest_rate (e.g. 0.15) – highest keyword rate per subpage

- frequency_per_keyword: {‘food’: 3478, ‘nutrition’: 347, ‘foods’: 694, ‘beverage’: 0, ‘drinks’: 0, ‘snacks’: 0} – dictionary of number of keyword occurrences per keyword

Picture Source: Brooke Lark

Results of our keyword analysis

In the next paragraph, we are focusing on insights derived from our keyword research, which was based on our list of the 2,500 largest VC investors worldwide.

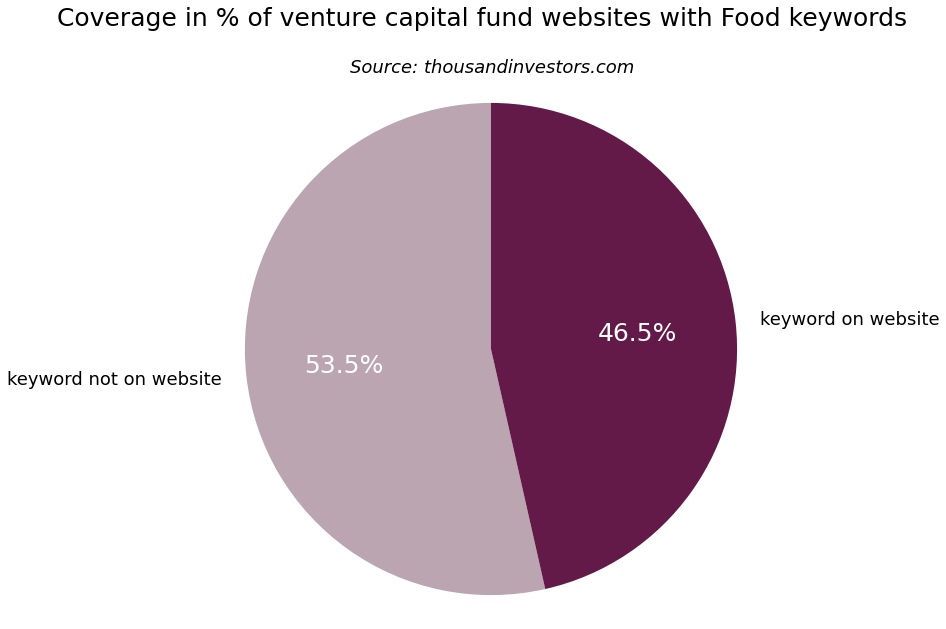

Percentage of VC funds that invest in start-ups in the food sector

Our keyword crawler analyzed more than 2,500 venture capital funds regarding food investment keywords. We found out that 46.5 % of the global VC funds mention food.

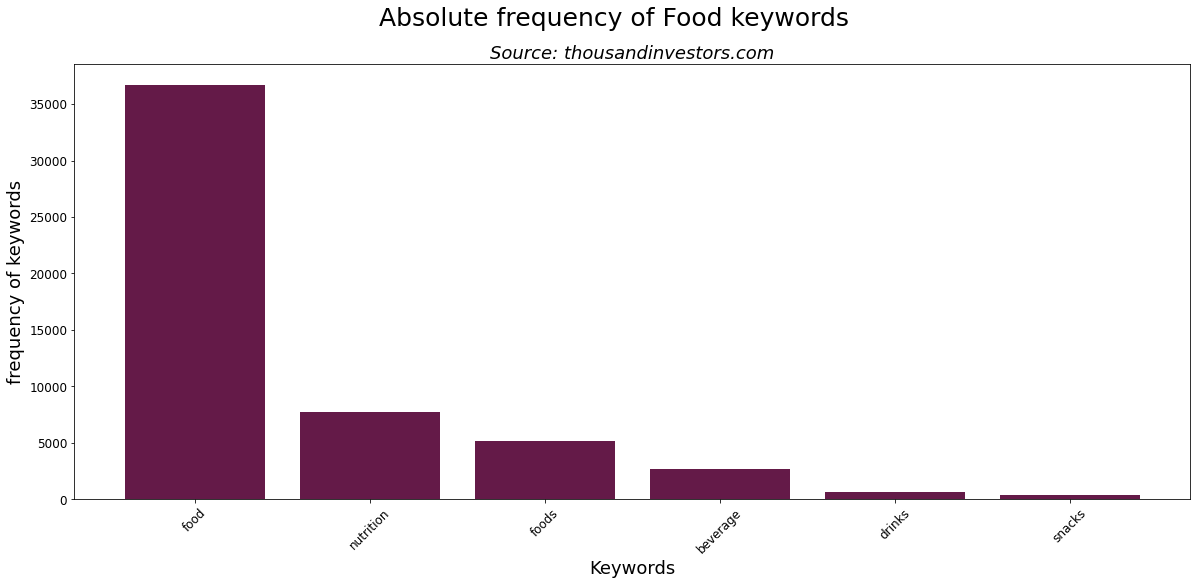

Focus on food and nutrition

This bar chart shows the most important keywords from our keyword search, however most companies use the keyword food to describe their vc company focus. Additionally, the terms nutrition, foods, and beverages are used whereas drinks and snacks are not as frequent.

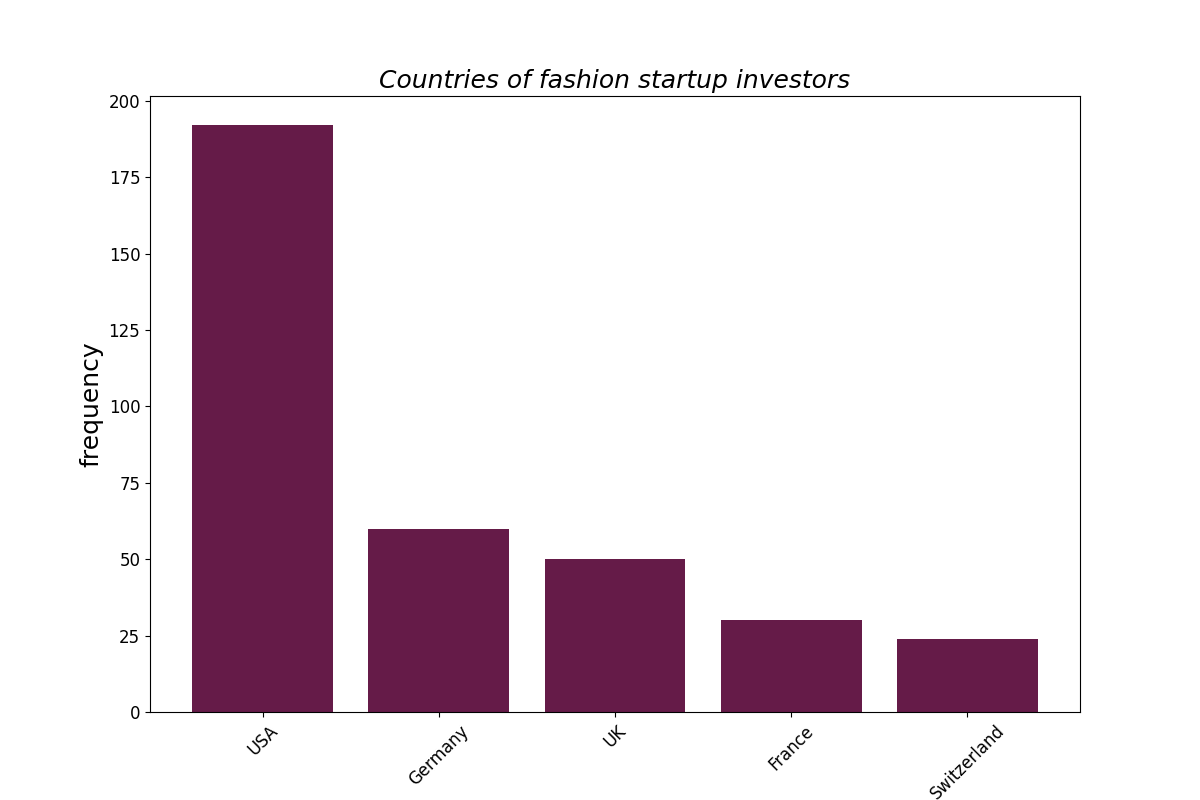

Countries of food startup investors

The most common countries for food startup investors are the USA. For instance, the previously presented investor Tyson Ventures is located in Springdale, Arkansas. Also, a lot of food investors are located in Germany, the UK, Switzerland, and France. These countries are known for their strong food industries and have a long history of producing high-quality food and beverages. In addition, many of these countries are home to world-renowned chefs and restaurants, which makes them attractive locations for food startups looking to make a name for themselves. As a result, these countries are home to many successful food startups and are popular destinations for investors looking to invest in the food sector.

![List of the 1,000 largest Food Venture Capital Investors [Update 2024] List of the 1,000 largest Food Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Food-Investors-List-1.png?media=1715161852)

![List of the 600 largest Fashion Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Fashion-Investors-List-1.png?media=1715161852)

![List of the 250 largest Proptech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Proptech-Investors-List.png?media=1715161852)

![List of the 400 largest AgTech Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Agtech-Investors-List.png?media=1715161852)

![List of the 250 largest Web3 Venture Capital Investors [Update 2024]](https://usercontent.one/wp/www.thousandinvestors.com/wp-content/uploads/2022/11/Web3-Investors-List.png?media=1715161852)

Edmund (verified owner) –

Good entries, thanks